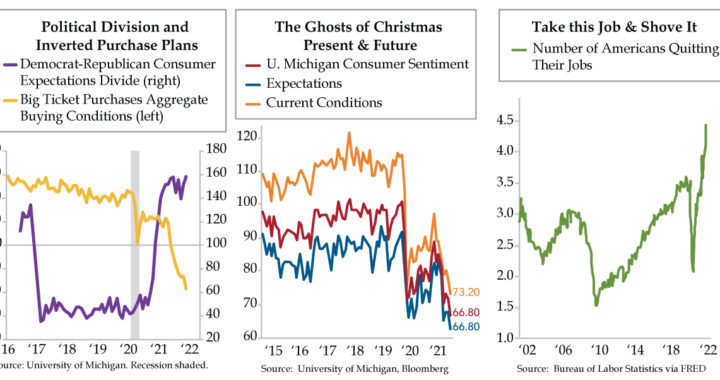

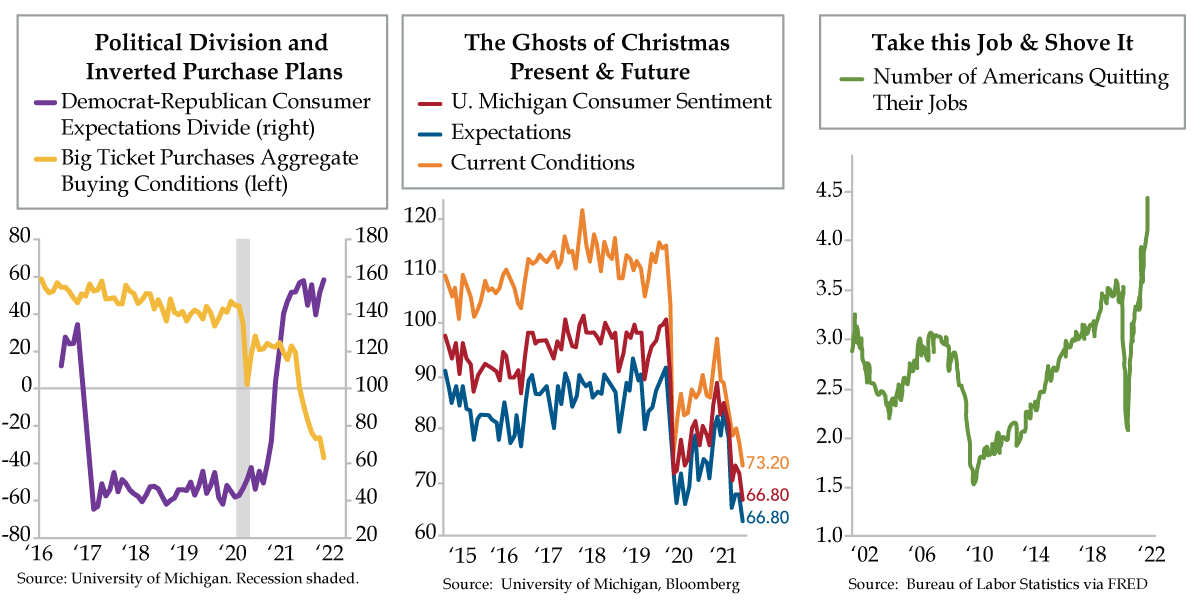

QI TAKEAWAY — “Transitory” inflation is now catalyzing bankruptcies in America. As much as we hear about the bravado of job hoppers, job losses necessarily follow companies going out of business. The ‘stag’ in stagflation is rearing its ugly head. We know we’ve been swimming upstream for months against the tide of buyside and sell-side steepening calls. We remain comfortable with our call.

- Bankruptcy filings for companies with at least $50 million in debt hit three in the week ended November 12 vs. nearly 15 seen in June 2020; though the Fed’s credit backstop limited creative destruction, corroded supply chains are pressuring firms that survived the pandemic

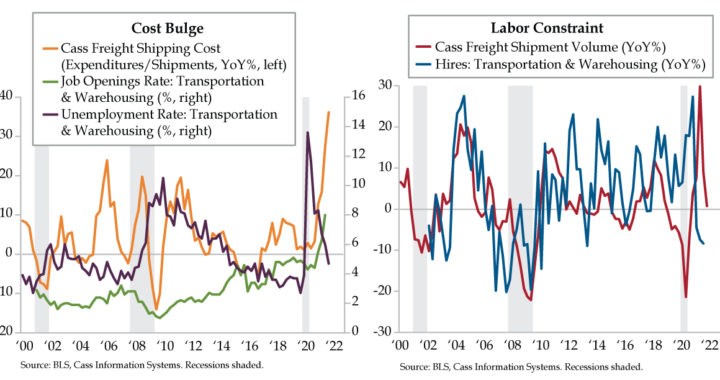

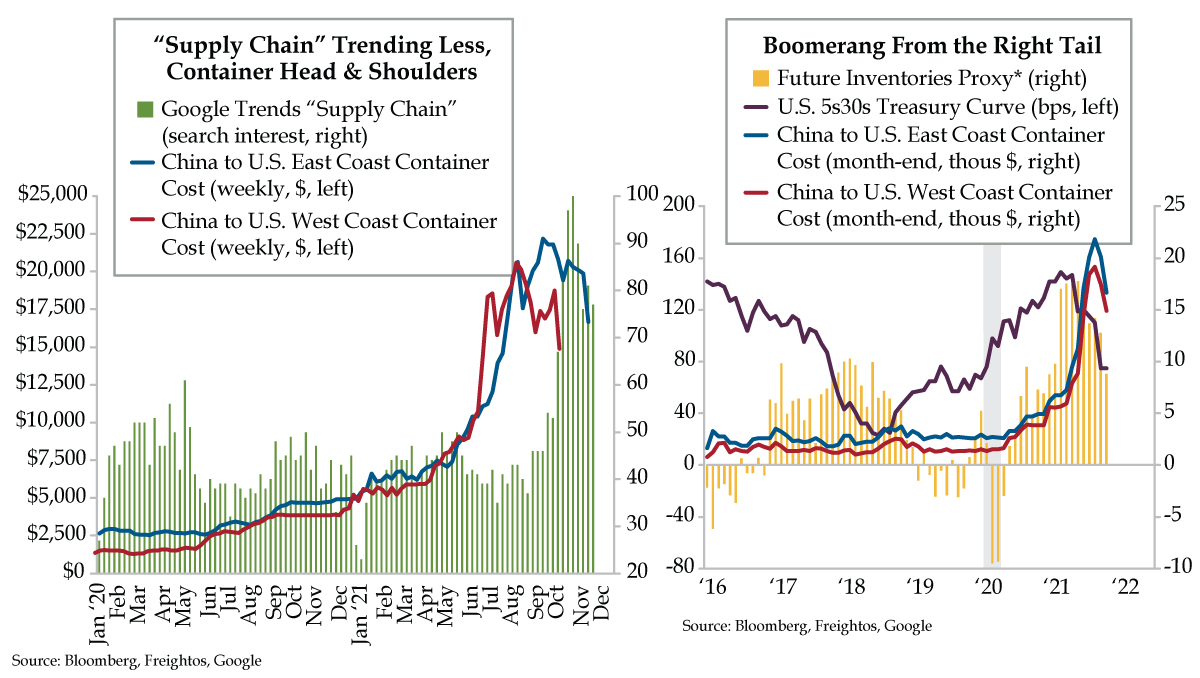

- An average of Future Inventories from regional Fed surveys suggests that panic buying by firms has subsided; the same message, which harms future GDP math, can be seen in the tightening of the 5s/30s curve corroborated by a decline in Google “Supply Chain” searches

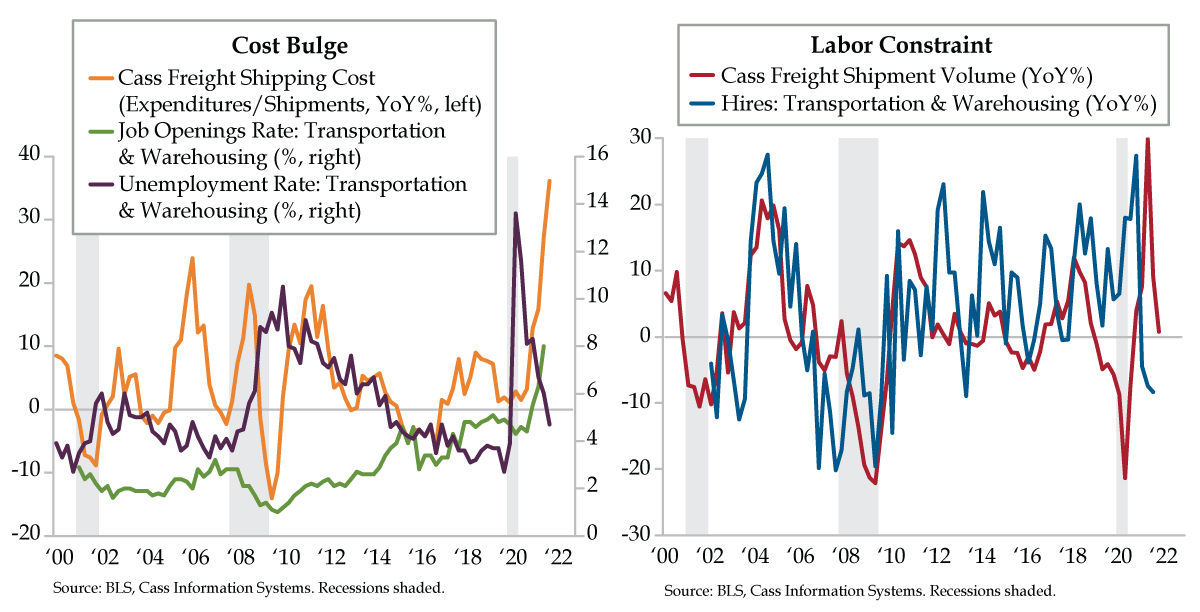

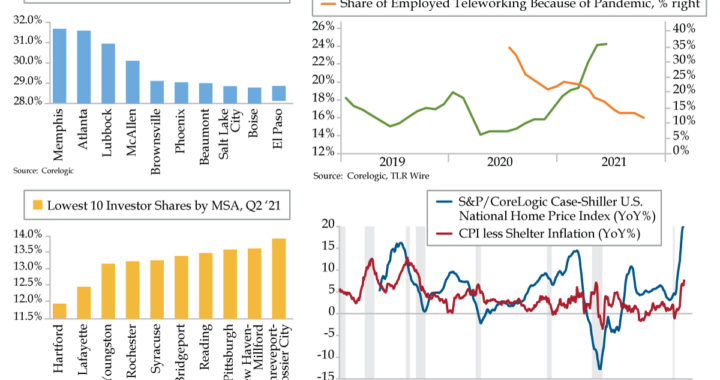

- Per Freightos, container costs from China to the US’s East and West Coasts have finally begun to turn; should the downward trend continue, prices may begin to fall back down to Earth for consumers as well as for businesses struggling to manage elevated input costs