QI TAKEAWAY — Overbuilding is as foreign a concept as any investor can conceive given the undersupply that’s weighed on the housing market for the past decade. Investors should, nonetheless, prepare themselves for this inevitability as the stars align given the confluence of overbuilding into an over-invested MSA backdrop.

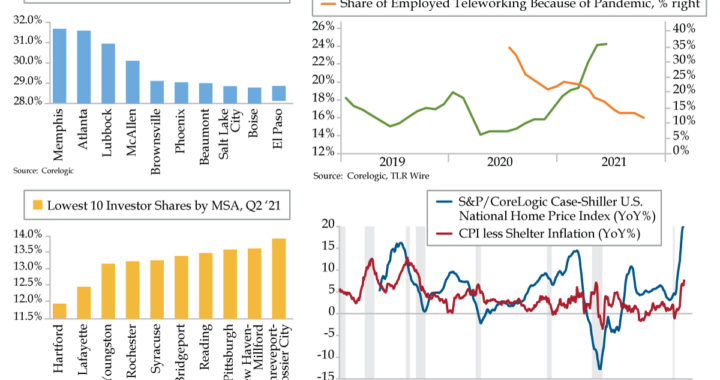

- Per CoreLogic, Memphis is the most desirable housing market for investors, with the rest of the top 10 spread across the South and Mountain-West; conversely, the least attractive housing markets for investors, save for two cities in Louisiana, are in the Northeast

- Pre-pandemic moratorium, Memphis historically had one of the highest eviction rates of any MSA at 6.1%; this suspension of lower-end supply sent rent inflation 19% over the 2014-2020 trend-line, but as evictions resume, new supply should give a reality check to investors

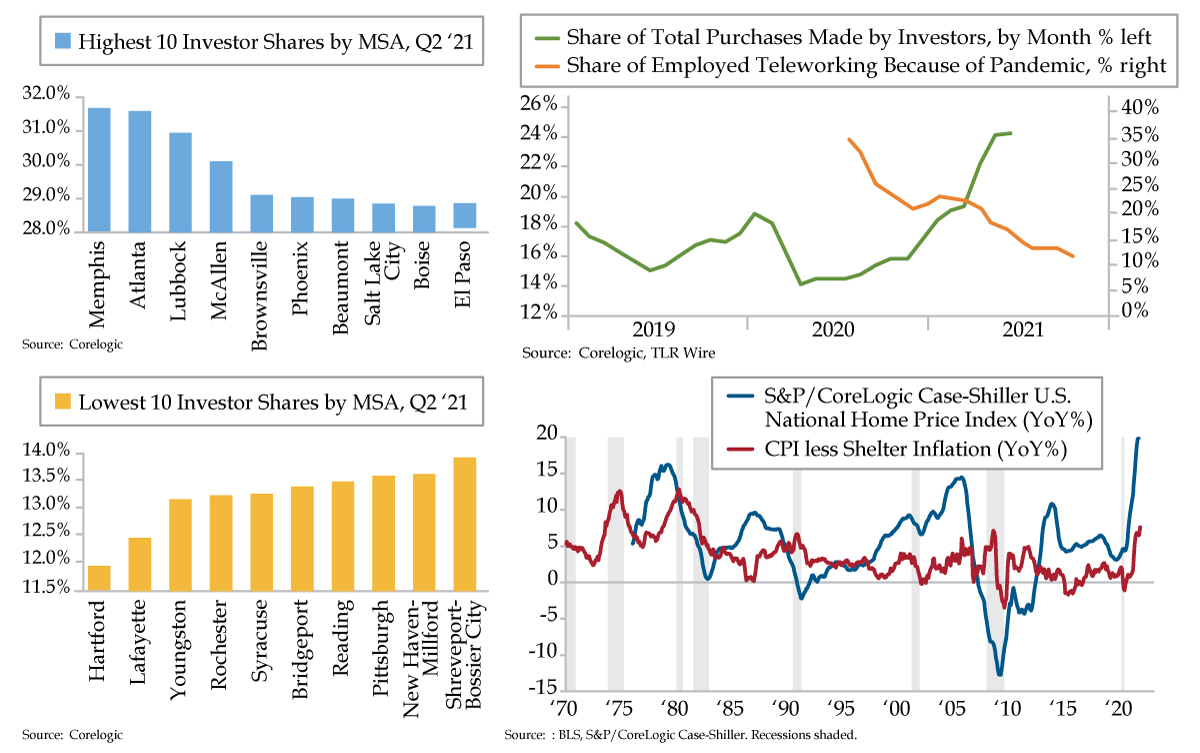

- The share of employees working from home has now fallen from 35.4% of the workforce in May 2020 to just 11.6% last month; with investors doubling down on their housing market purchases in spite of this, oversupply could soon apply pressure to an overheated market