Inflation Re-Harkens the Specter of Bankruptcies

November 22, 2021

QI TAKEAWAY — “Transitory” inflation is now catalyzing bankruptcies in America. As much as we hear about the bravado of job hoppers, job losses necessarily follow companies going out of business. The ‘stag’ in stagflation is rearing its ugly head. We know we’ve been swimming upstream for months against the tide of buyside and sell-side […]

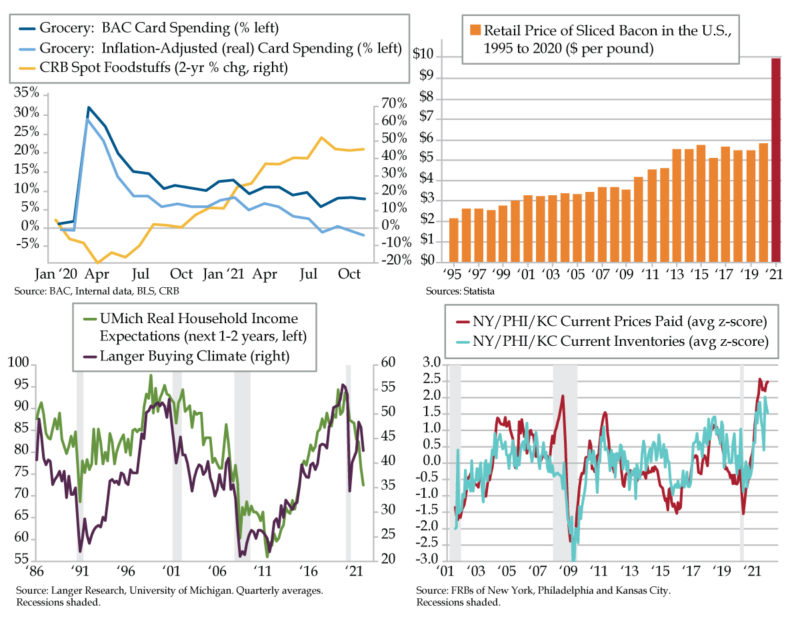

Households Hitting Budgetary Breaking Point

November 19, 2021

QI TAKEAWAY — Consumer Discretionary has been on a tear, fueled by aspirational buyers and those on the receiving end of the Fed’s trickle up policies. Taking some profits in the sector could prove prudent. Per Bank of America, the percentage change in inflation-adjusted grocery spending on a 2-year basis slipped further into contraction in […]

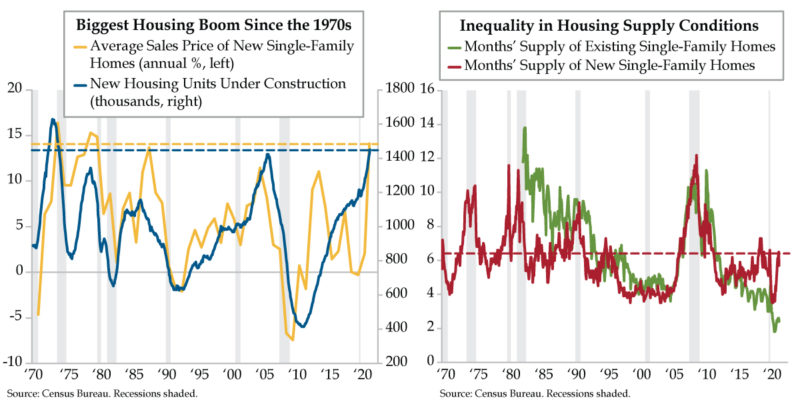

Caveat Emptor: Keep Building

November 18, 2021

QI TAKEAWAY — Home builders have property appreciation at their back to mathematically justify keeping the building machine up and running. A shift to supply conditions north of long-run averages could, however, flag a move out of the right tail for pricing power after an impossibly long run of undersupply that’s left most investors in […]

Defense Wins Championships

November 17, 2021

QI TAKEAWAY — Retail sales are being inflated by pervasive demand/supply imbalances that could morph into challenged consumer purchasing power. We get that our call against consumer discretionary has been way too early, and therefore costly. But that can’t take away from the new element of a lack of stimulus spending coupled with the dual capitulations of […]

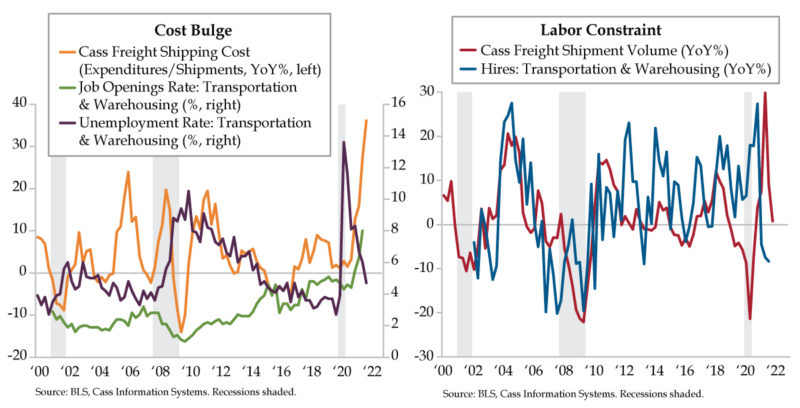

Long Transports

November 16, 2021

QI TAKEAWAY — Record freight cost inflation is safeguarding transportation stocks’ prospects despite a slowdown in shipment volumes. Cass freight shipping costs saw a 36.2% YoY gain in October, the largest on record, as supply chain disruptions persist; though logistics costs have surged, shipment volume has calmed thus far in Q4 to a 0.8% YoY […]

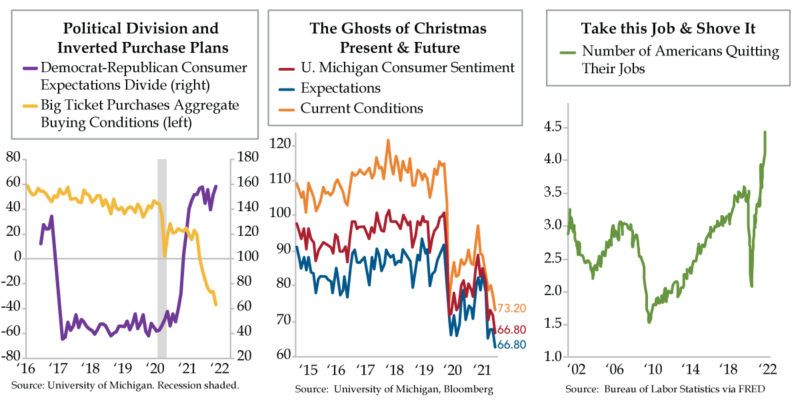

Fear Overcomes Bravado

November 15, 2021

QI TAKEAWAY — The inflation hysteria is hard to ignore. The slowing economy in the background, however, commands a louder message. We appreciate how far behind the curve the Fed is. That’s precisely why we reiterate our flattening call originated May 10th, when the Street was ALL IN on the steepener trade. The economy slowing […]

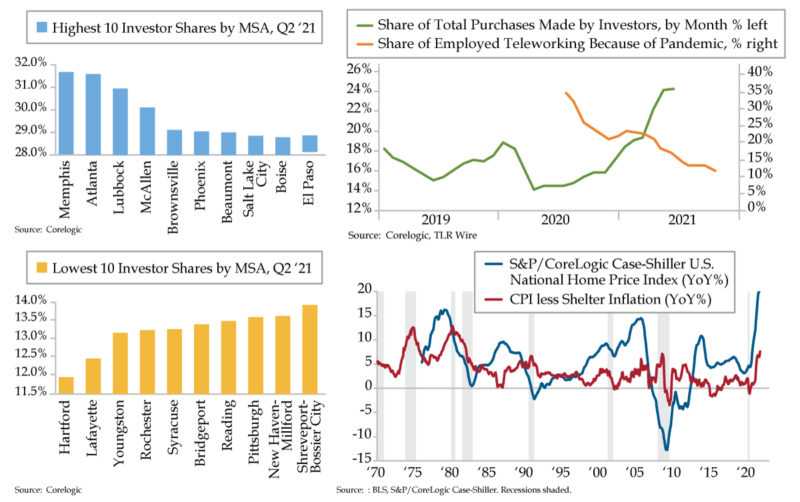

Fading the Housing Inflation Hysteria

November 12, 2021

QI TAKEAWAY — Overbuilding is as foreign a concept as any investor can conceive given the undersupply that’s weighed on the housing market for the past decade. Investors should, nonetheless, prepare themselves for this inevitability as the stars align given the confluence of overbuilding into an over-invested MSA backdrop. Per CoreLogic, Memphis is the […]

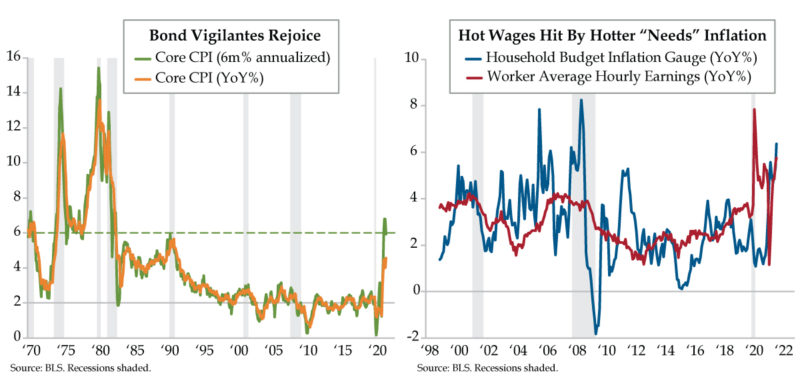

Inflation Reaches a Fevered Pitch

November 11, 2021

QI TAKEAWAY — The bond vigilantes were back out in force in the U.S. Treasury market yesterday. Echoes of the 1970s from the core CPI ratify the rational response from the inflation surprise. However, nondiscretionary inflation, the kind that cannot be avoided, is part of the run up – and will act as a governor […]

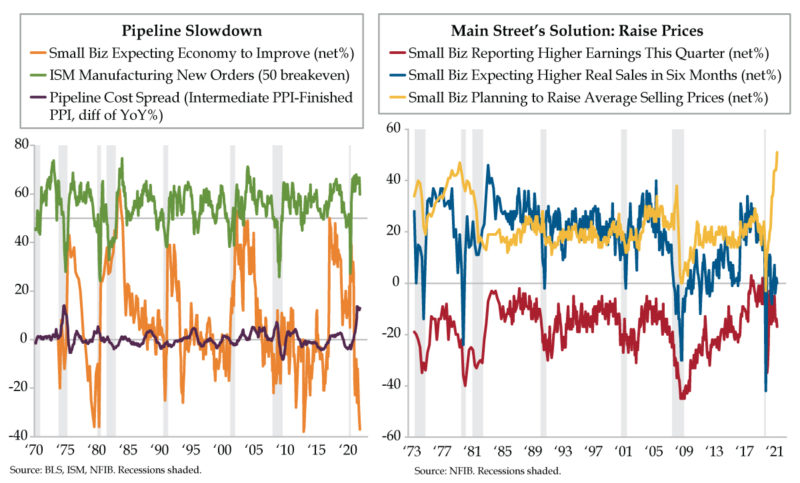

1970s-Style Pipeline Pressures

November 10, 2021

QI TAKEAWAY — Persistent pipeline pressures risk a slowdown in the most visible leading indicator – U.S. ISM Manufacturing New Orders. Main Street has already sniffed out this risk and is endeavoring to raise prices to defend against stalling revenue and profit headwinds. We re-repeat, a curve-flattener is still the most likely outcome. PPI […]

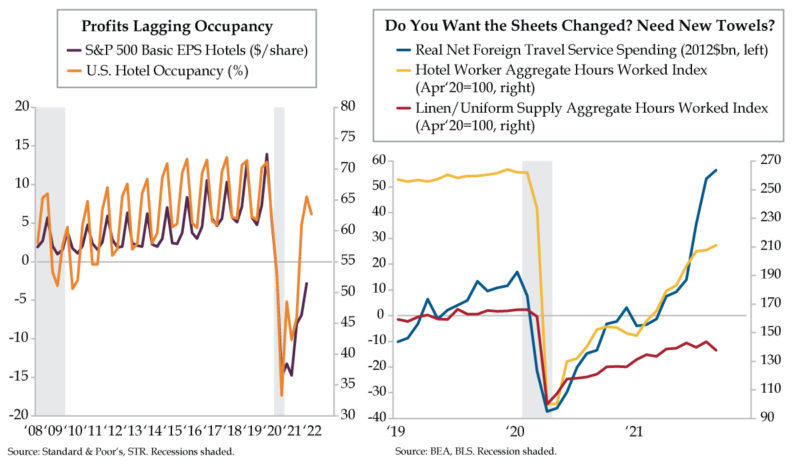

Opening Borders & Upping Profits in Lodging

November 9, 2021

QI TAKEAWAY — Econ 101 dictates that opening borders could mean a smaller ‘C’ for travel spending shifted to a larger ‘X’ for travel services. Hotels stand to gain from additional foreign travel but should keep cost-saving initiatives in place all in the name of productivity and profits. The S&P 500 Basic EPS Hotels was […]