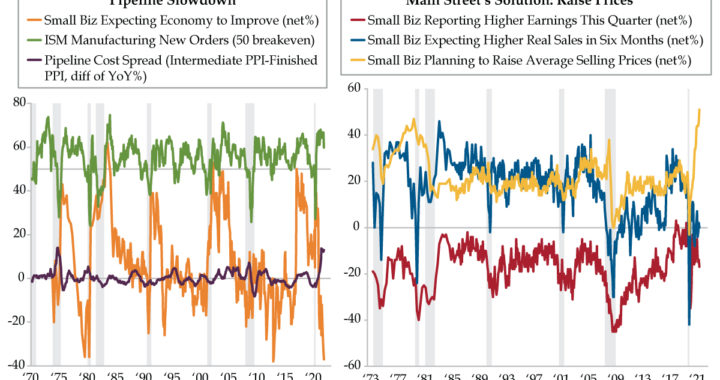

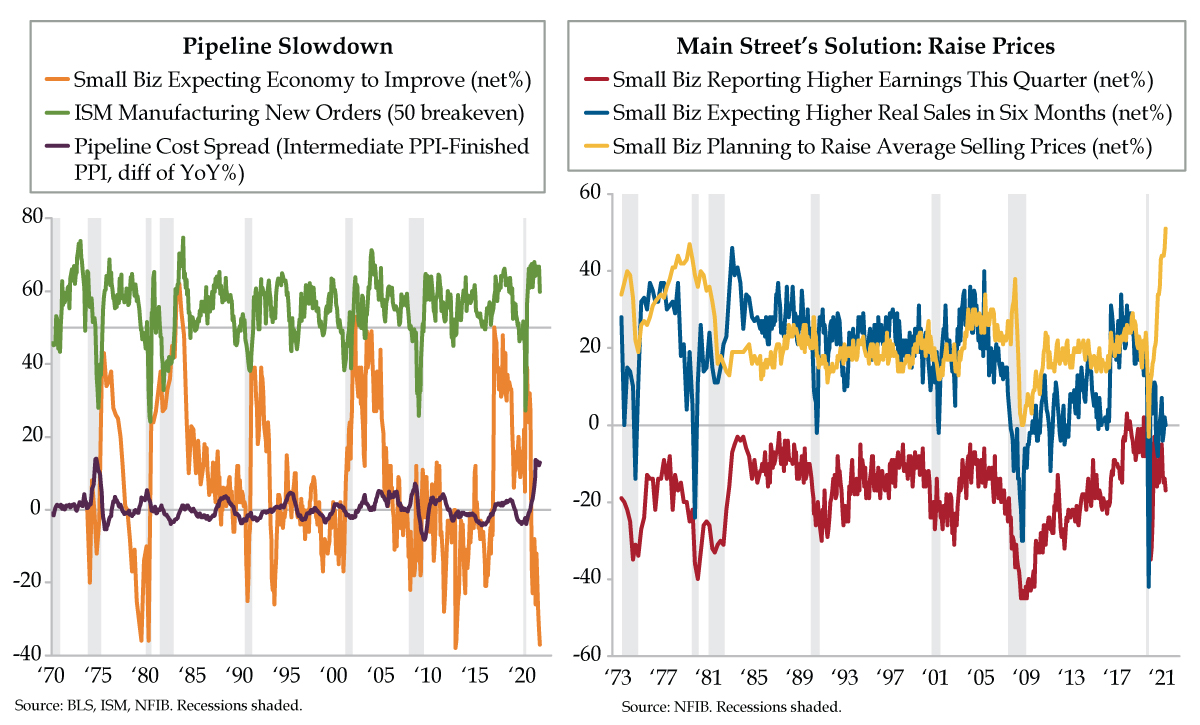

QI TAKEAWAY — Persistent pipeline pressures risk a slowdown in the most visible leading indicator – U.S. ISM Manufacturing New Orders. Main Street has already sniffed out this risk and is endeavoring to raise prices to defend against stalling revenue and profit headwinds. We re-repeat, a curve-flattener is still the most likely outcome.

- PPI inflation for intermediate goods has exceeded the same metric for finished goods by a double-digit margin for the last six months; only the seven-month stretch from July 1974 to January 1975 compares historically, as pipeline pressures risk bleeding into consumer prices

- ISM Manufacturing New Orders, though still above the 50-breakeven, has fallen below 60 after a 15-month streak north of that threshold; further declines could continue to push down Small Business Expectations, already at near record pessimism due to elevated uncertainty

- In the NFIB October survey, a record 51% of small business owners said they plan to raise prices in order to combat higher material, transport, and labor costs; with core PCE printing at 4.4% vs. the 2% target, the latest CFO Survey also validates the rising input cost dilemma