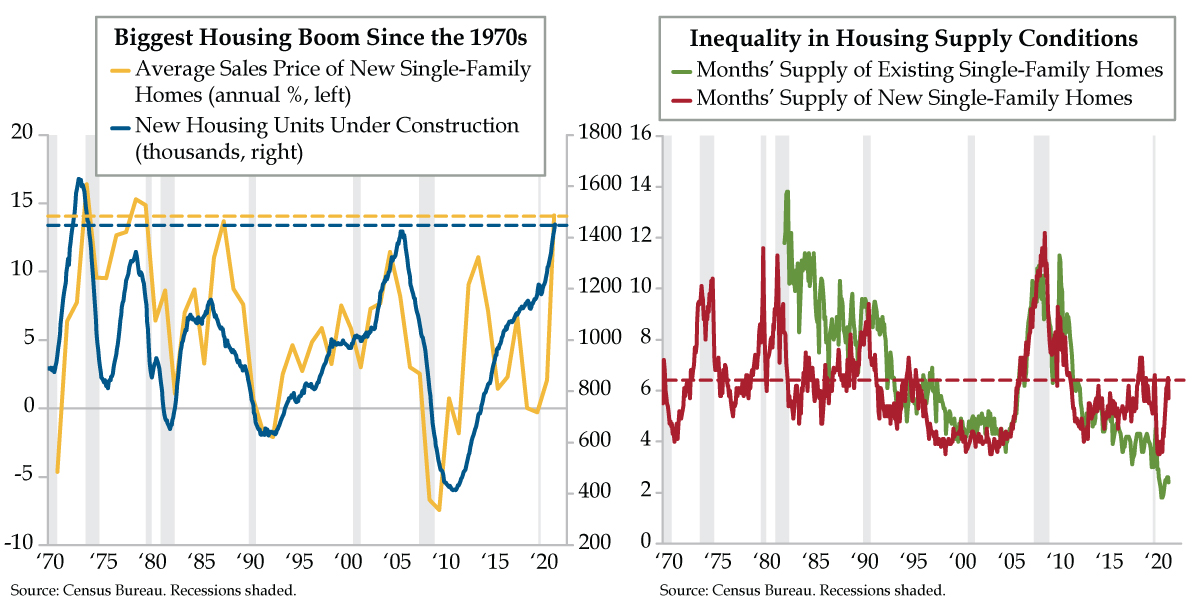

QI TAKEAWAY — Home builders have property appreciation at their back to mathematically justify keeping the building machine up and running. A shift to supply conditions north of long-run averages could, however, flag a move out of the right tail for pricing power after an impossibly long run of undersupply that’s left most investors in the sector vastly unprepared.

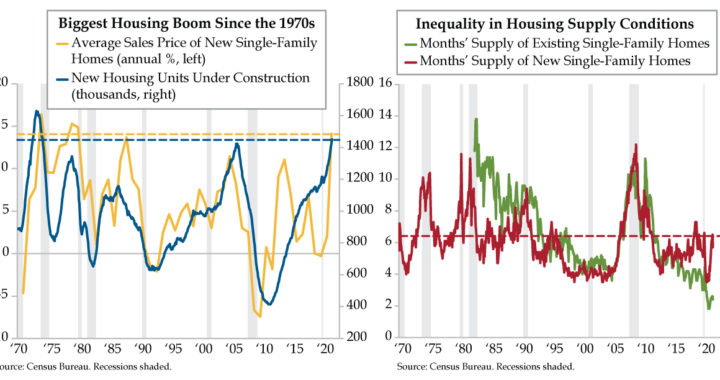

- New homes under construction rose to 1.451 million in October, eclipsing the 2000s peatilk of 1.426 million circa March 2006; the last time units under construction were higher was the 1970s, though the current boom critically lacks the same underlying population growth rates

- Unsold existing single-family home inventories sit at 2.4-months, a record low with no prior reading below 3 in data back to 1982; meanwhile, the undersupply of new single-family homes in 2020 has given way to prints closer to the long-term average of 6 months in 2021

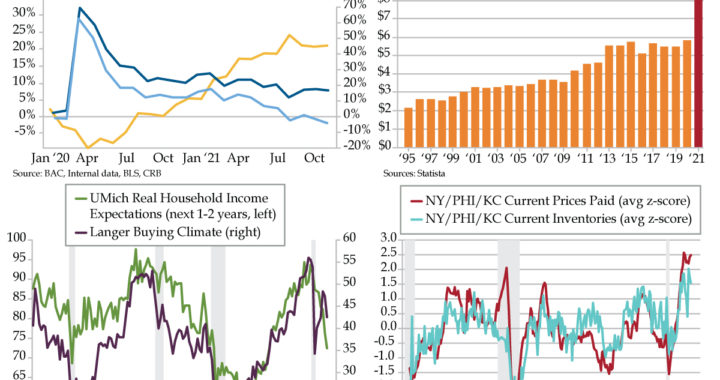

- A record 28% of new single-family homes for sale are “Not Started” – a massive backlog of unbuilt homes; however, with buying conditions, per University of Michigan, inverted for the first time since the 1980s, demand will be challenged by the high pricing environment