QI TAKEAWAY — Retail sales are being inflated by pervasive demand/supply imbalances that could morph into challenged consumer purchasing power. We get that our call against consumer discretionary has been way too early, and therefore costly. But that can’t take away from the new element of a lack of stimulus spending coupled with the dual capitulations of rental evictions and inflation that’s choking working U.S. households’ budgets. And we’re only 17 days away from the McConnell debt ceiling moment even as Biden has announced he’ll name his choice for Fed chair on a Saturday, when markets are safely closed for trading. Paring more cyclical consumer positions might be a prudent course of action.

- October’s 1.7% MoM retail sales print was the largest since March and more than four times greater than the 0.4% long-term average; however, given these are nominal terms, deflating them using the CPI shows real retail sales remain 6% below March’s post-pandemic high

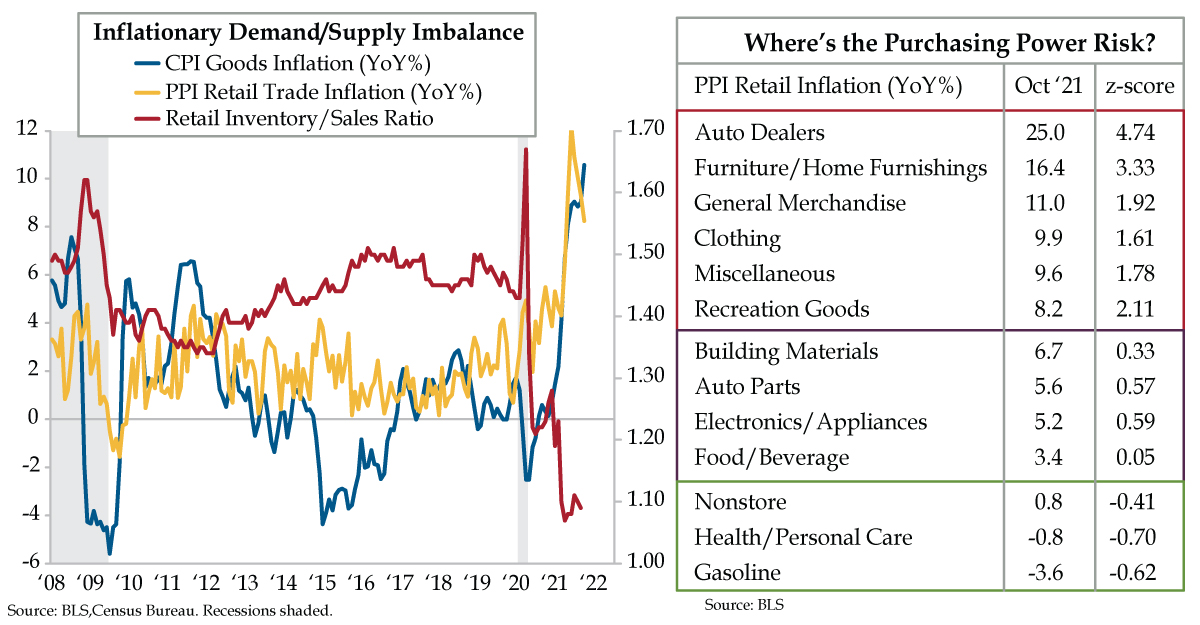

- At 1.09, September’s retail inventory/sales ratio hovered just above April 2021’s record low 1.07 print; prior to the pandemic, this metric had never fallen below 1.3, with fiscal stimulus helping to drive a persistent supply/demand imbalance and pull forward consumer spending

- PPI retail trade inflation, though off its June peak of 12.2% YoY, remained high in October at 8.2%; as z-scores, retail inflation is rising at above-trend rates in six sectors, notably autos, furnishings, general merchandise, clothing, miscellaneous goods, and recreation goods