VIPs

- October’s 1.7% MoM retail sales print was the largest since March and more than four times greater than the 0.4% long-term average; however, given these are nominal terms, deflating them using the CPI shows real retail sales remain 6% below March’s post-pandemic high

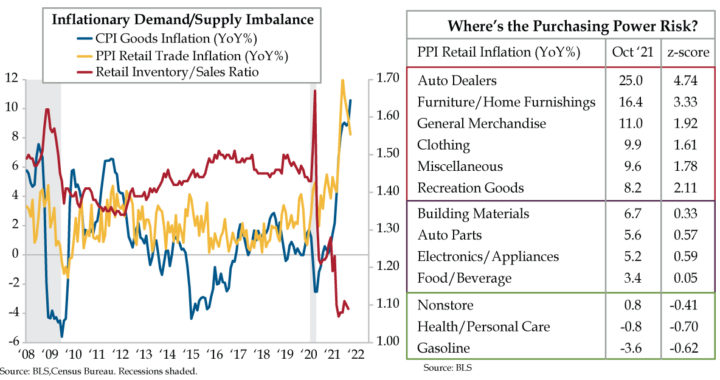

- At 1.09, September’s retail inventory/sales ratio hovered just above April 2021’s record low 1.07 print; prior to the pandemic, this metric had never fallen below 1.3, with fiscal stimulus helping to drive a persistent supply/demand imbalance and pull forward consumer spending

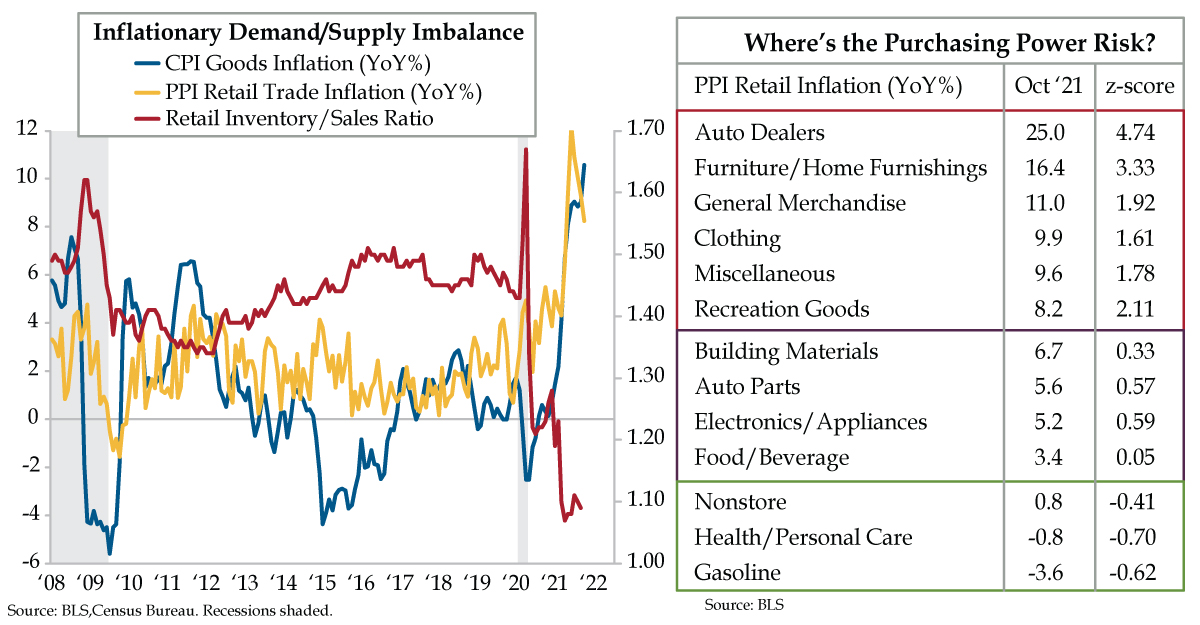

- PPI retail trade inflation, though off its June peak of 12.2% YoY, remained high in October at 8.2%; as z-scores, retail inflation is rising at above-trend rates in six sectors, notably autos, furnishings, general merchandise, clothing, miscellaneous goods, and recreation goods

Daniel Pugh was born in Zanesville, Ohio and raised in Mason, about 30 minutes north of Cincinnati. One of six children, he played basketball at William Mason High School and leveraged his court skills to a basketball scholarship at Eastern Kentucky University where he majored in communications. After college, he was an on-air radio personality at WTUE in Dayton from 1979-83 and moved on to CNN as a sports reporter from 1983-89. His big break came at ESPN, when he dropped his surname for his middle name ‘Patrick.’ The rest, as they oft say, is history. Fans of ESPN’s SportsCenter remember Dan Patrick’s pairing with Keith Olbermann, which elevated the program to star status. But it was Patrick’s catch phrases that are the stuff of legend. Who can forget “The WHIIIFFFF!” or “NOTHING but the bottom of the net!” or “We’re going to ooooovertime” or “You can’t stop him, you can only hope to contain him”?

Pugh’s indelible imprint on popular sports culture propted Sports Illustrated to create a dictionary of Dan Patrick’s terminology. Probably the most memorable and recognizable utterances was, “(Dare I say) En fuego.” This reference translates smoothly to yesterday’s U.S. economic calendar. October retail sales were en fuego. The 1.7% headline gain that includes food services bested the 1.4% consensus estimate, and was not only the largest monthly increase since the stimulus-juiced month of March 2021 (up 11.3% month-over-month), but was more than four times greater than the long-run average run rate (0.4% per month). This marked the third straight gain, and the longest winning streak for retail spending in about a year.

The good news prompted the Street to upgrade fourth-quarter consumer spending forecasts, especially with “control group” retail sales, the direct input into personal consumption, starting off the autumn quarter nearly 12% (annualized) above the third quarter average, following a 3.2% quarter-over-quarter annualized advance in 2021’s third quarter.

To say that retail sales were inflated is an understatement. Recall, the Census Bureau reports the data in nominal dollar terms; they are a product of price * quantity. The purer retail sales series that excludes food services ring-fences goods spending. Through this lens, nominal retail sales reached a record high in October, eclipsing the April 2021 level by 0.6%. Never more dollars in the cash register. Cha-ching!

Volume matters. However, when deflating these figures by the consumer price index (CPI) for goods, October real retail sales stood 6.0% below the March post-pandemic high point. Looking at the retail space from this angle flags significant ground to recover in this phase of a normalization after the last of the stimulus checks produced the bulge in spending earlier this year.

For perspective, CPI goods inflation rose to a 10.5% year-over-year (YoY) rate in October (blue line) a level last seen in the inflation mountain ranges of the 1970s and early 1980s. (An aside – it’s remarkable that President Jimmy Carter is alive to witness this phenomenon. One can only imagine what he thinks of “transitory”!)) Alternatively, the producer price index (PPI) has a similar measure from the retailers’ perspective. The PPI for retail trade inflation also has accelerated in tandem with the CPI measure, reaching double-digit territory – and a 12.2% YoY peak in June – before ebbing to a still high 8.2% in October (yellow line).

These parallel lines are the byproduct of the demand/supply imbalance in the retail sector. Yesterday’s U.S. business inventories report revealed that at 1.09, September’s retail inventory/sales ratio remained awfully close to April 2021’s record low of 1.07 (red line). The history of the series is critical to this discussion — prior to COVID-19, the retail inventory/sales ratio never fell below 1.30. Stimulus on steroids – 42.3% of GDP directly deposited into the checking accounts of millions who didn’t need the money — helped drive excess demand that fueled the persistence of the undersupply, which then drove the two legs down to record lows.

Pervasive retail undersupply. Note that low inventory/sales ratios spread far beyond the auto sector. Home goods, such as furniture and home furnishings; electronics and appliances; building materials; food and beverages; clothing and accessories; and general merchandise all face below normal supply conditions relative to the level of demand.

While prices are boosting top-line retail sales, stubbornly high and rising prices could act as a governor on future spending through hits to consumer purchasing power. The table above illustrates this by delving into the granularity in the PPI data.

Retail inflation in six categories color coded in red – autos, furniture/home furnishings, general merchandise, clothing, miscellaneous goods and recreation goods – is expanding at above-normal rates. This is depicted in the far-right column using z-scores, deviations from the mean adjusted for volatility. Those colored purple – building materials, auto parts, electronics/appliances and food and beverages – indicate inflation closer to normal rates. And the three in the green zone – nonstore (i.e., ecommerce), health and personal care, and gasoline – all sport price trends running at below-normal rates.

Dan Patrick should narrate the rest. Does diminishing purchasing power risk “Goodbye…Game over…Drive home safely” for the U.S. consumer? “Gone” is not how you would prefer to see your unrealized portfolio profits. Those long in the consumer discretionary sector might be wise to be “going against the grain” and pare positions. Remember “defense wins championships” and persistent purchasing power headwinds suggest performance in more cyclical spaces in retail could face more challenges. “Alongside my tag team partner, I’m merely Dan Patrick.”