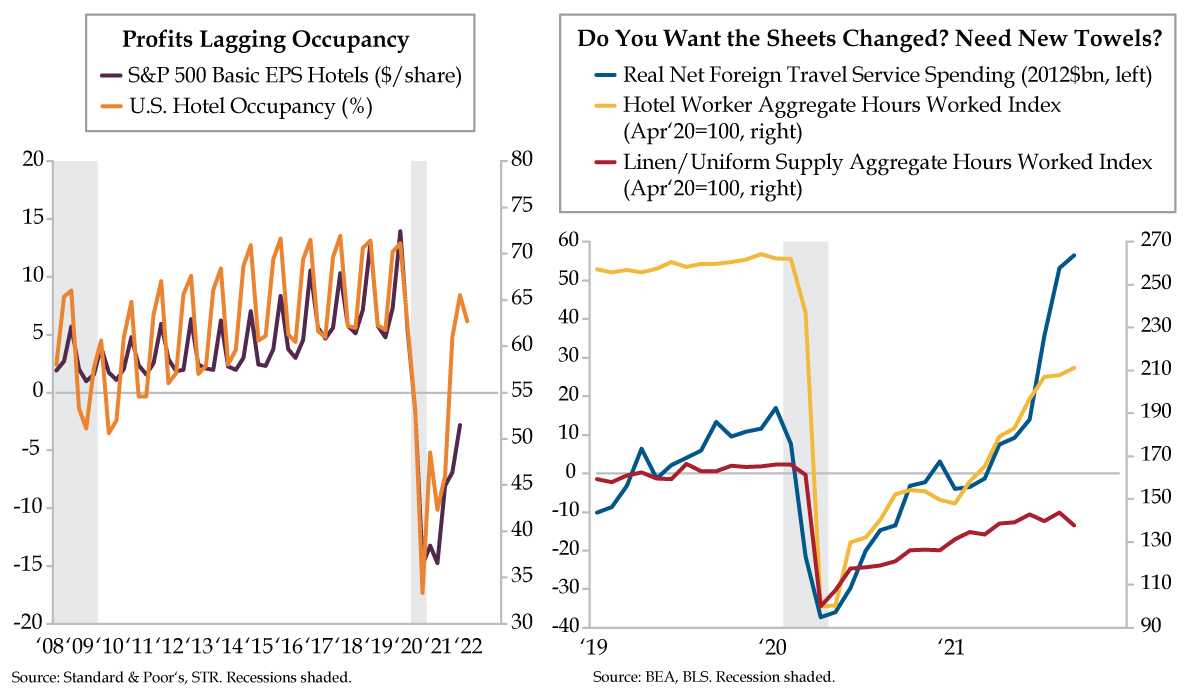

QI TAKEAWAY — Econ 101 dictates that opening borders could mean a smaller ‘C’ for travel spending shifted to a larger ‘X’ for travel services. Hotels stand to gain from additional foreign travel but should keep cost-saving initiatives in place all in the name of productivity and profits.

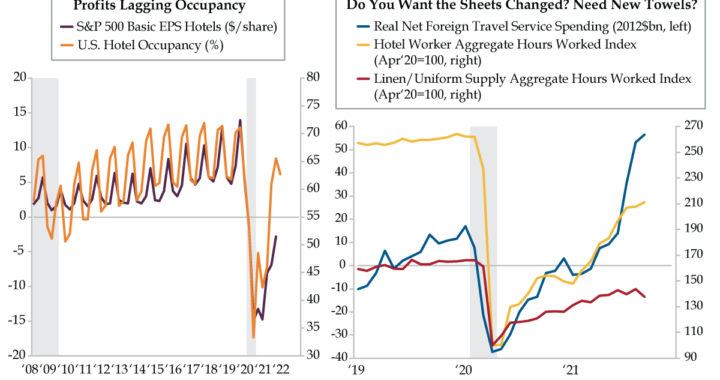

- The S&P 500 Basic EPS Hotels was never negative until 2020, and has stayed in contraction for the last seven quarters; despite their historically tight correlation, hotel occupancy has recovered to pre-pandemic levels while hotel profits lag on account of higher input costs

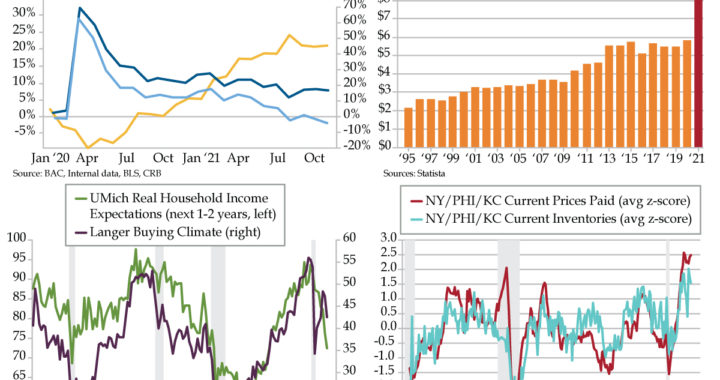

- Since bottoming out in April 2020, hotel workers have seen their aggregate hours worked recover 111%; meanwhile, linen/uniform supply workers have only risen 38%, diverging from the former as services previously contracted out are brought in-house to cut costs

- Per Cirium, airlines are increasing flights between the UK and U.S. by 21% MoM as U.S. borders are re-opened to vaccinated travelers; inflows from nonresident travelers should drive service consumption, though this will manifest in GDP accounting as export services