VIPs

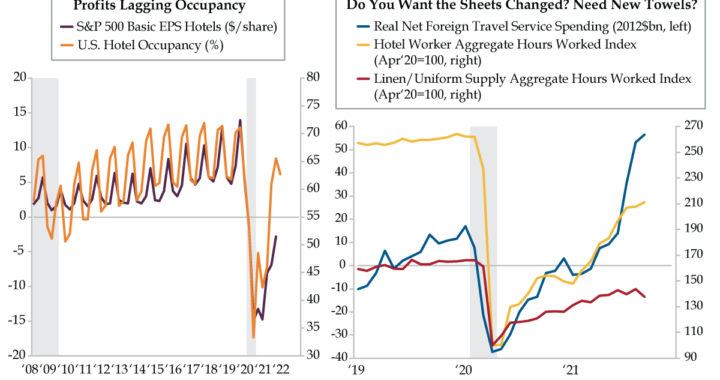

- The S&P 500 Basic EPS Hotels was never negative until 2020, and has stayed in contraction for the last seven quarters; despite their historically tight correlation, hotel occupancy has recovered to pre-pandemic levels while hotel profits lag on account of higher input costs

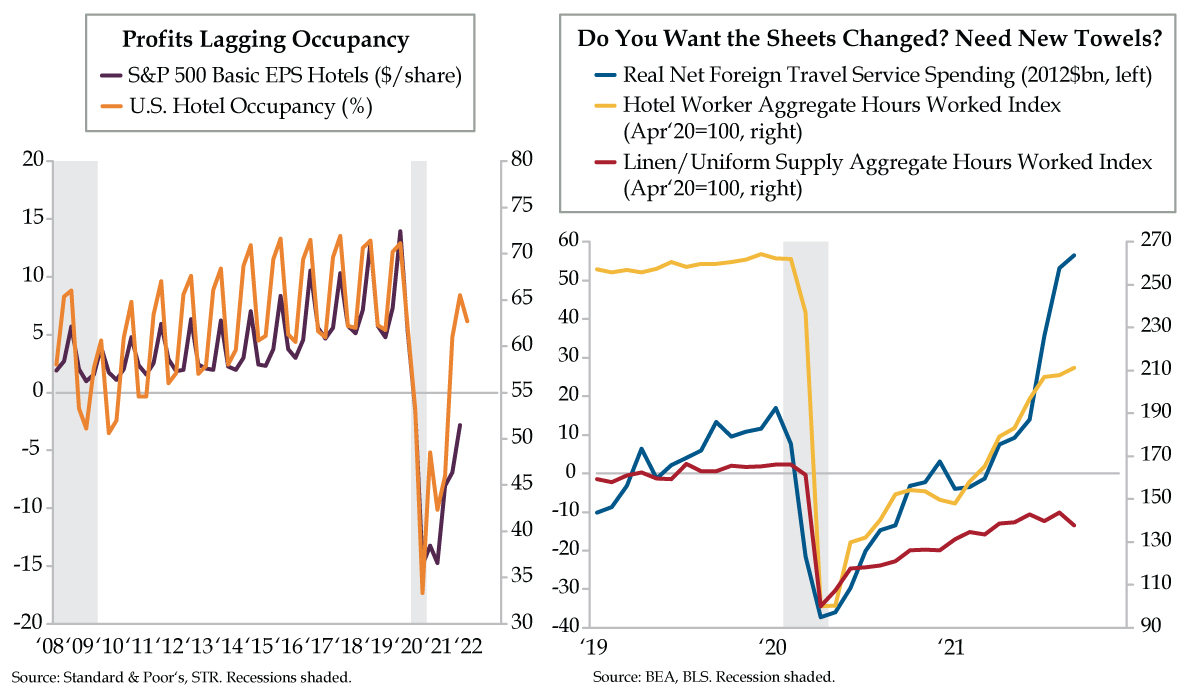

- Since bottoming out in April 2020, hotel workers have seen their aggregate hours worked recover 111%; meanwhile, linen/uniform supply workers have only risen 38%, diverging from the former as services previously contracted out are brought in-house to cut costs

- Per Cirium, airlines are increasing flights between the UK and U.S. by 21% MoM as U.S. borders are re-opened to vaccinated travelers; inflows from nonresident travelers should drive service consumption, though this will manifest in GDP accounting as export services

We go together

Like rama lama lama ka dinga da dinga dong

Remembered forever

As shoo-bop sha wadda wadda yippity boom de boom

Chang chang changitty chang sha-bop

That’s the way it should be

Wah-oooh, yeah!

The tongue-twisting opening lines to the final song of the 1978 musical romantic comedy Grease can’t help but bring a smile to your face. Many (ill-sighted) critics saw the film as mediocre, condescendingly describing it as “a pleasing, energetic musical with infectiously catchy songs and an ode to young love that never gets old.” The timeless classic featuring greaser Danny Zuko and Australian transfer student Sandy Olsson found its place in the archives in 2020 when the film was selected for preservation in the National Film Registry by the Library of Congress as being culturally, historically and aesthetically significant. What took them so long?

Going together in economics has a different connotation than “Summer Lovin,’” “Hopelessly Devoted to You,” and “You’re the One That I Want.” Eyeballing what Danielle calls a “huggy-bear” relationship between two distinct gauges gains credence when the correlation (better known as the ‘r’) rises to noteworthy heights, which you see on the left. Over time, the seasonal movement in U.S. hotel occupancy (orange line) has been a key driver of operating earnings per share (EPS) in the S&P 500’s hotel sector (purple line). We know we’re not breaking new ground in deducing that demand for hotel stays, whether for business or leisure, drives revenue per available room — the industry metric for top-line activity.

However, in the post-COVID-19 world, a disconnect has emerged. Hotel EPS has had a record run in negative territory, while hotel occupancy has fully recovered to pre-pandemic levels. Never before 2020 had the S&P 500 hotel sector recorded contracting EPS. Seven quarters later, it appears permanent damage has been inflicted.

As for the light at the end of the tunnel, with profits lagging occupancy, major lodging operators have gotten creative to save on the cost side of the ledger. Even at what we once considered “posh digs,” services are limited. The norm these days is your room is serviced every third day, meaning never for most staying 2-3 nights. That duration is standard fare for the leisure traveler who’s largely replaced the once lucrative business traveler. The front desk is most cordial about explaining the effective inflation — you are paying more for less — as “You understand, with the COVID restrictions and all…” Savvy travelers have learned a few tricks — ask for towels to be replenished, fresh toiletries delivered and then they make their own damn beds if they need to return to a room that’s tidied up.

This has played out in a diverging recovery between hotel workers and those whose services are contracted out, such as those in the linen and uniform supply industries that also includes industrial laundries. In an industry like accommodation, workers’ input is essentially the equivalent of the businesses’ output. Aggregate hours worked, a measure of the number of payroll jobs times the average workweek, is the conventional way to judge guidance.

As you see on the right, both hours worked series for hotel workers and linen/uniform supply workers were indexed to the COVID low point of April 2020. Normalizing as such determines if both groups would recover in concert. It’s clear that they have not. By June 2020, hours worked for hotel workers began to outperform that of the linen/uniform supply group – and they never looked back. To date, through September 2021, the former rose 111% off the bottom, while the latter only advanced 38%.

For the most part, the recovery in hotel activity has been limited to domestic travelers. That’s about to change. As announced Sunday, after 20 months of travel restrictions, U.S. land and air borders are reopening to foreign visitors. The new rules allow air travel from previously restricted countries if the entrant has proof of vaccination and a negative COVID-19 test. Land travel from Mexico and Canada will require proof of vaccination, but no test. Airlines are expecting more travelers from Europe and elsewhere. Data from travel and analytics firm Cirium show airlines are increasing flights between the United Kingdom and the U.S. by 21% this month over October.

How this encouraging news could play out in gross domestic product (GDP) math is another story. U.S. net foreign travel services — the difference between what U.S. residents spend in foreign countries and what foreigners spend in the U.S. — is about to roll off its peak September print. The pent-up demand of inflows of nonresident tourists should be the more influential factor driving service consumption. For what it’s worth, in the three months ended September, net foreign travel had accounted for nearly one-third of all real consumer spending on services. The wind is about to shift on consumer spending. That said, it will manifest as export services in the trade gap, so all is not lost. Any growth from the influx of foreign travels should be a net-plus for the trade gap.

The way GDP accounting works suggests reopening borders will be a wash as activity moves from consumption to exports. The math for the hotel industry is much more straightforward – any incremental travel demand will support a return to profitability. In the interim, expect cost-saving initiatives to become a more permanent staple for hotel operators, all in the name of productivity and profits first.