QI TAKEAWAY — Margins are being challenged by the enormous level of bravado among workers who know their value in the labor force. The economy is slowing, which is evident in declining workweeks and contracting job postings in two of the hottest post-pandemic sectors. And it appears as if the long-term scarring in the workforce will be worse than that of the post-GFC era. There’s every reason for the 10-year to have traded down to 1.47% and the 2s/10s to be flirting with 100 basis points. Maintain your stances.

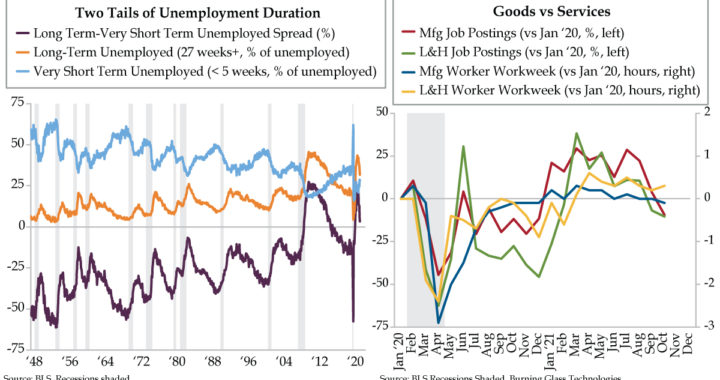

- At 28.3%, those who have been unemployed for fewer than five weeks are now at a post-pandemic high; meanwhile, 31.6% of the unemployed have been out of work for more than 27 weeks, a 13-month low but still well above the 19.3% registered in February 2020

- After hitting a high of 41.7, the manufacturing worker workweek has fallen to 41.3, the lowest since December 2020; in leisure and hospitality, the workweek peaked at 25.3 hours in April with the last round of stimulus checks, before falling slipping back to 25.0

- Per Burning Glass, job openings in manufacturing are at -9.5% in the week ended October 29 vs. January 2020, the first negative read since last November; at -10.5%, leisure & hospitality openings have contracted for the last two weeks to their worst showing since January