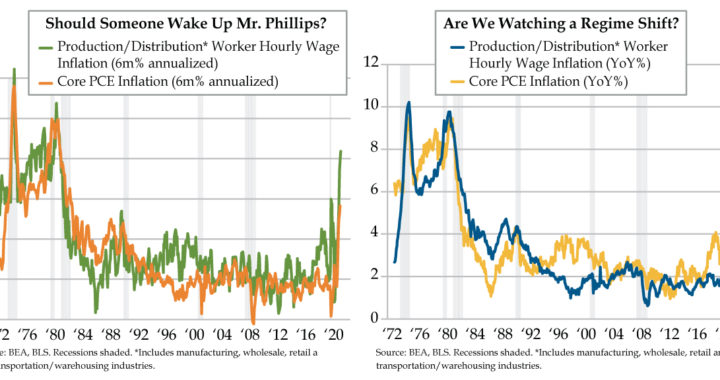

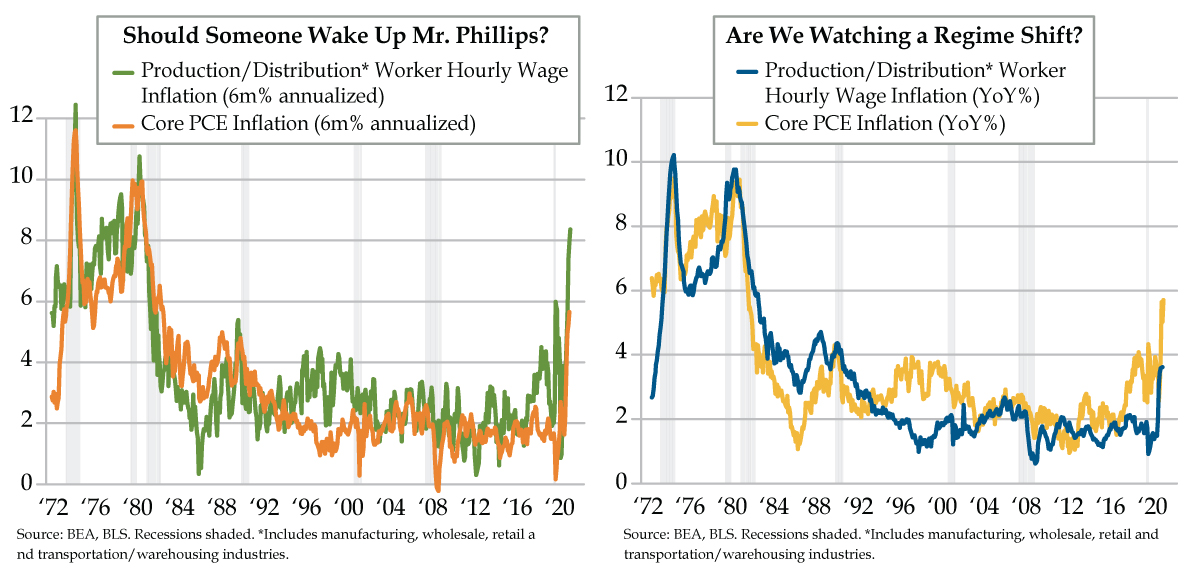

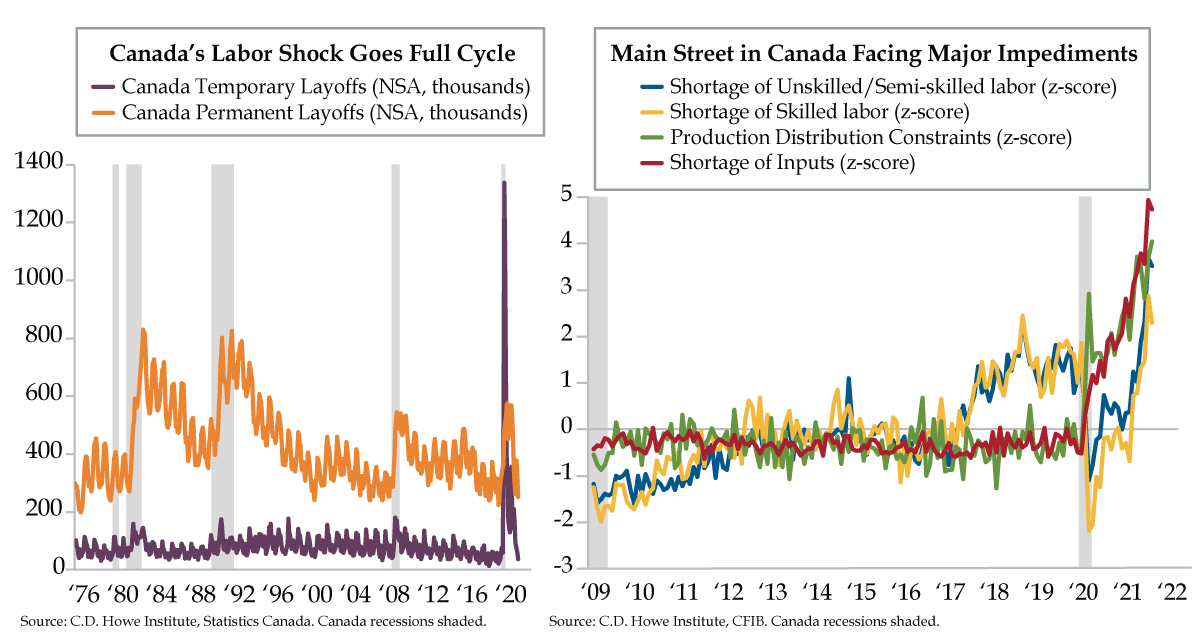

QI TAKEAWAY — Canada’s labor market has fully recovered. Upstream costs pressures on Main Street point to persistent inflation risks downstream. Watch for Canada’s yield curve to stay flatter than that of the U.S. These rate differentials suggest favoring U.S. banks over Canadian ones.

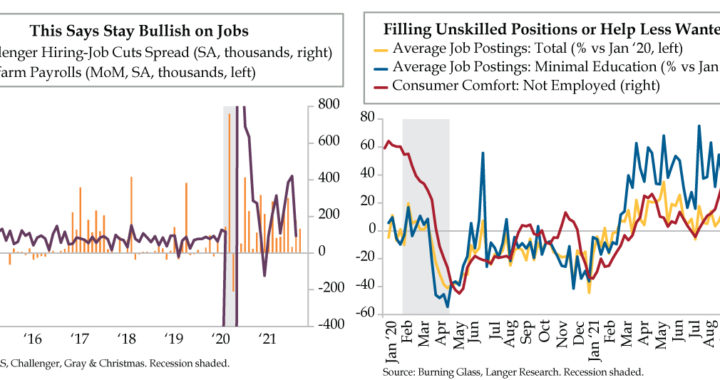

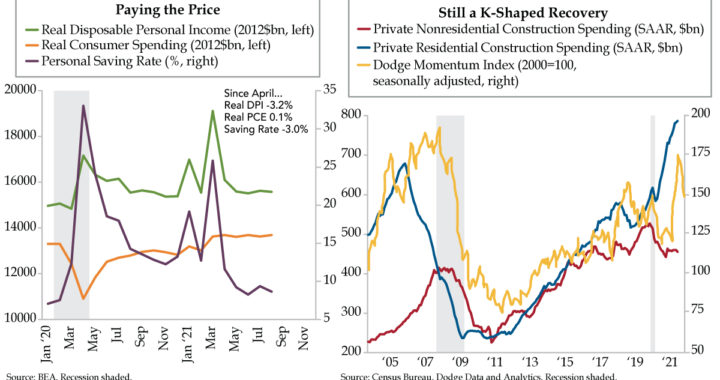

- Canada saw 157,000 jobs gained last month, more than 2.5 times the consensus and above every estimate in the Bloomberg survey; the 0.8% MoM pushed employment back to pre-pandemic levels and would have translated to a proportional 1.2 million bump in the U.S.

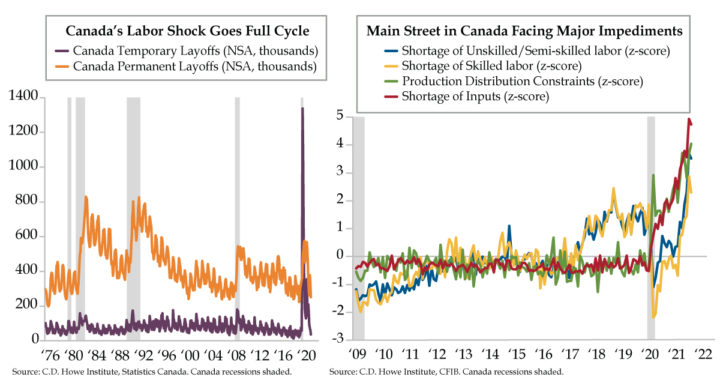

- Unlike in the U.S., Canada’s labor shock appears to have gone a full cycle, with both temporary layoffs and permanent job losers seeing a recovery; labor force participation has returned to 65.5%, and the labor progress made has led the BoC to taper three times already

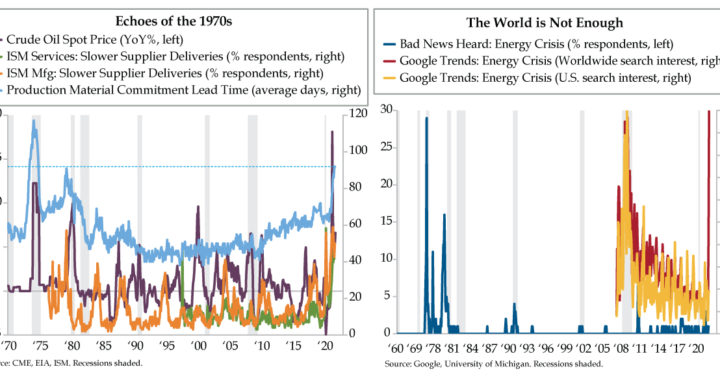

- Per the CFIB, in the six months through September small business’ average price plans over the next year have run north of 3%; at present, CPI trim and CPI median are both above the BoC’s 2% target at 3.3% and 2.6%, respectively, risking cost pressures flowing downstream