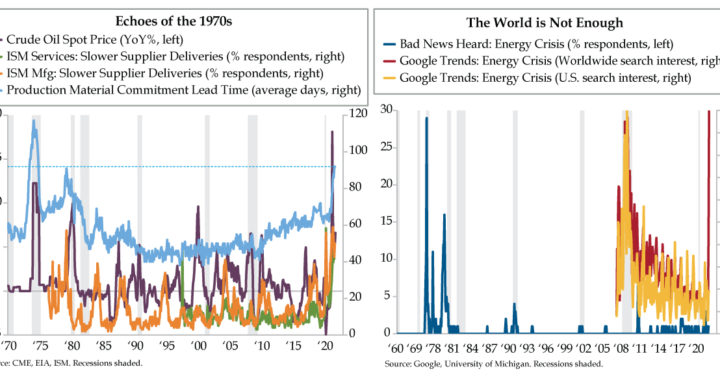

QI Takeaway — Echoes of the 1970s are filtering through the industrial supply chain. Lead times for inputs were last longer in 1974. Oil price inflation persistence for another month could change the narrative. A long volatility position might be a prudent hedge.

- Per ISM, September’s 92-day average lead time for production materials was the highest since October 1974; deliveries also slowed after three months of progress, with more than 50% of respondents reporting slower deliveries for just the seventh time since the mid-1970s

- Crude oil spot prices have seen YoY gains of more than 60% for the last eight months, echoing the run-up to the 2008 financial crisis; should persistence extend to nine months, the comparison to 1974, which saw 12 months north of 60% YoY gains, will be more relevant

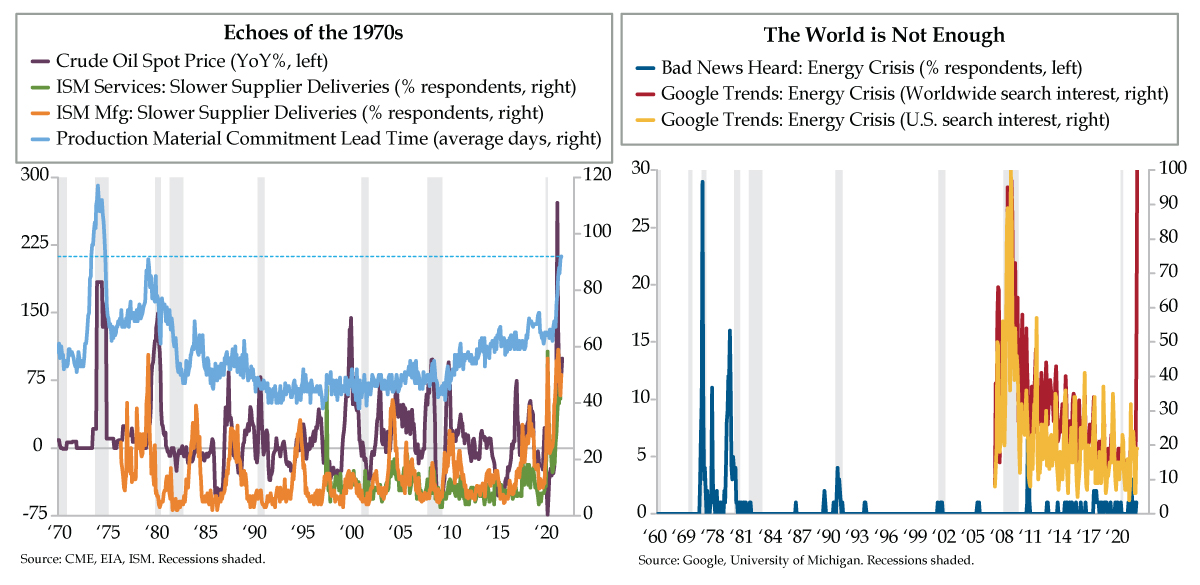

- Bad News Heard: Energy Crisis has barely registered in recent years of UMich’s Survey of Consumers; while Google searches for “energy crisis” in the U.S. were at a 19 out of 100 in October, worldwide interest hit 100, a sign that an energy crisis is underpriced here at home