VIPs

- Over the last week, IHS Markit has lowered its Q3 GDP estimate (as has the Atlanta Fed), from 3.6% to 1.5%, a far cry from Bloomberg’s 5.0%; driving the downgrade is a stall in private demand, which is working against increasing government spending and inventories

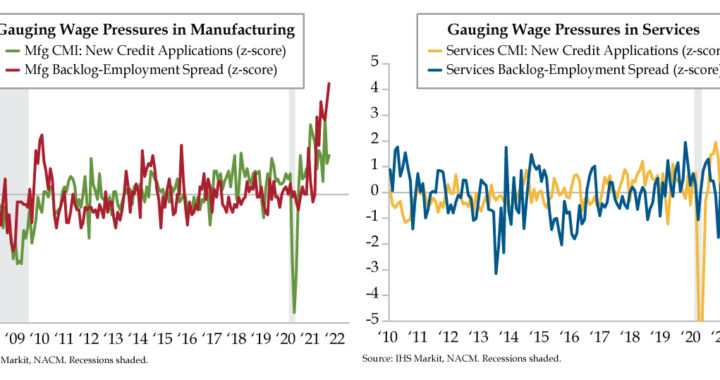

- In both the manufacturing and services sectors, the Backlog-Employment Spread, per IHS Markit, is at a historically high z-score; although both are likely to continue seeing wage pressures, the issue is most acute in manufacturing, a function of its innate cyclical nature

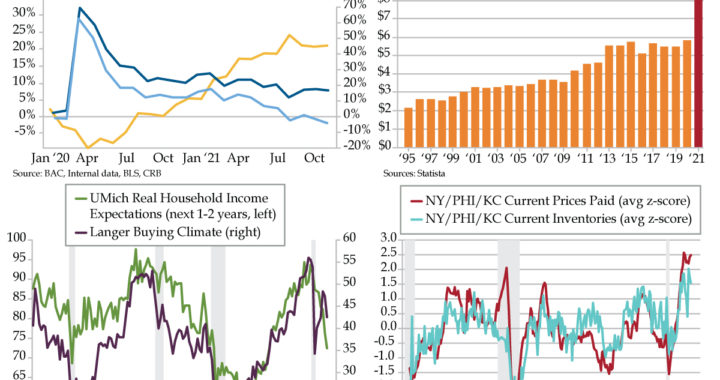

- The National Association of Credit Management found more firms expanding their credit lines in September in order to stockpile and address supply chain stability concerns; though higher leverage may be needed to weather higher costs, it also creates added right-tail risks

What has 12 million monthly shoppers, generated savings of more than $8.7 billion and been in business for 21 years? If you said Slickdeals.net, you know your shopping sites. Slickdeals is a social platform for shopping that harnesses the power of crowdsourcing. Every deal is sourced and shared by real people. The Slickdeals online community and team of skilled editors do their level best to uncover great products and layers of savings. In 2019, CNBC picked up a Slickdeals-researched story on rock star household budget busters. It asked 2,000 adults about their budgeting habits and weekly spending. The top 10 budget killers were as follows (percent of respondents): online shopping (40%), grocery shopping (39%), subscription services (37%), technology products (36%), buying lunch everyday (35%), household essentials (32%), coffee (32%), food delivery (32%), gym memberships (30%), entertainment like movies and concerts (29%).

Black Friday has been falling earlier on the calendar for years. This year, vendors have pre-warned shoppers that the wait will be so long it will likely spoil the holidays. Shopping sites such as Slickdeals will thus attract more clicks in advance. Would-be shoppers are trying to safeguard their budgets. The same cannot be said for businesses across the U.S. economy.

Faced with higher costs beyond their control, many firms have likely burned much of the midnight oil (that’s in short supply) in their financial planning and analysis (FP&A) departments. One anonymous source from a long-standing wholesaler/distributor to a regional supermarket shared with Dr. Gates that his establishment has gone through three rewrites of its budget and not one has yet been approved. This is the first time this has ever happened in the company’s 35-year history. Translation: Hard decisions are coming down the line on the cost side.

Not every corporation is faced with the same circumstances. Some are even resorting to expanding budgets through increased borrowing to compete in the present economic environment. The September National Association of Credit Management’s (NACM) Credit Managers’ Index explained that companies seem to be ordering more than is normal, and thereby requiring additional credit, adding that “although an increase in demand could be the reason, businesses are likely stockpiling materials due to concerns about the stability of supply chains.”

As noted yesterday, it’s taking longer and longer to source said materials. This grabby quality could lead to too much supply against the backdrop of slowing demand. In fact, the experts at IHS Markit hinted at just that in their latest real-time tracking of the U.S. economy. Over the last week, IHS Markit economists (and those, we would add, at the Atlanta Fed), have been taking down their estimate for third-quarter gross domestic product (GDP) from 3.6% on September 30 to 1.5% on October 5. Their latest GDP tracking is a far cry from Bloomberg’s 5.0% consensus forecast.

In short, a stall in private demand has generated IHS’s downgrade. Household spending, business investment and international trade look to have amalgamated to a collective drag on economic activity that could fail to offset the expansion in government spending during the quarter. Inventories is the lone bright spot in the mix, accounting for more than the entire gain in GDP. But this asterisk is no cause for celebration.

When supply drives the GDP bus and final demand shifts into reverse (even if slightly) in a given quarter, it creates a reflex action by Street economists: slash the next quarter’s growth. That’s how you get a slowdown narrative to manifest. Watch for the consensus to start chasing third-quarter growth estimates down, then follow through with cuts to the fourth quarter after the GDP numbers go public on October 28.

We highlight this risk three weeks out because it feeds the outlook for the near-term revenue environment once we get into the third quarter earnings season. While revenues are always beyond a company’s control, wages are a constant operating cost that can be adjusted on the fly, either up or down.

That brings us to the two charts du jour. Both illustrate the same two metrics — one from the view of the manufacturing sector and the other from the perspective of the broader service sector. The two series from the National Association of Credit Management (NACM) depict the demand for new credit and proxy oscillations of movements in the borrowing department. We chose IHS Markit business surveys instead of those from the Institute for Supply Management (ISM) because the coverage is wider by firm size and the access reaches into C-suites. We applied our favorite normalizer – the z-score, or deviation from the mean adjusted for volatility — to level the playing field.

What we discovered was that both manufacturing and service sectors are facing the same issues regarding work piling up and not enough warm bodies to fill positions to get tasks done. The situation is more acute in the industrial sector so these cyclical industries will face more significant wage pressures. But the divergence is similarly substantial implying bigger carrots may need to be dangled to whittle down inboxes.

One way to combat a budget bust is to stare it down and lever up, which the factory sector will eagerly embrace. Service industries’ step down the production chain in wholesaling; transportation and warehousing shouldn’t be too far behind. Higher leverage will be needed to weather higher costs in the most cyclical parts of the economy. Got right tail problems?