QI Takeaway — The Fed’s QE has underpinned the home improvement sector. After COVID-19, this corner of residential real estate swelled to a record share of GDP – and it probably won’t stop there. Home price appreciation in high rent districts have underwritten the expansion, and top-end households have benefitted the most allowing for a sustained renovation cycle.

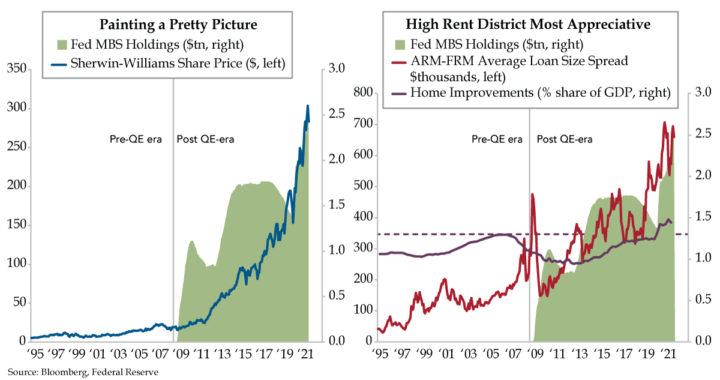

- From zero in 2008, the Fed has expanded its holdings of mortgage-backed securities to $2.54 trillion in September 2021; the Fed’s MBS holdings are tethered to housing proxy Sherwin-Williams, which has seen its stock price double since expanded QE began in March 2020

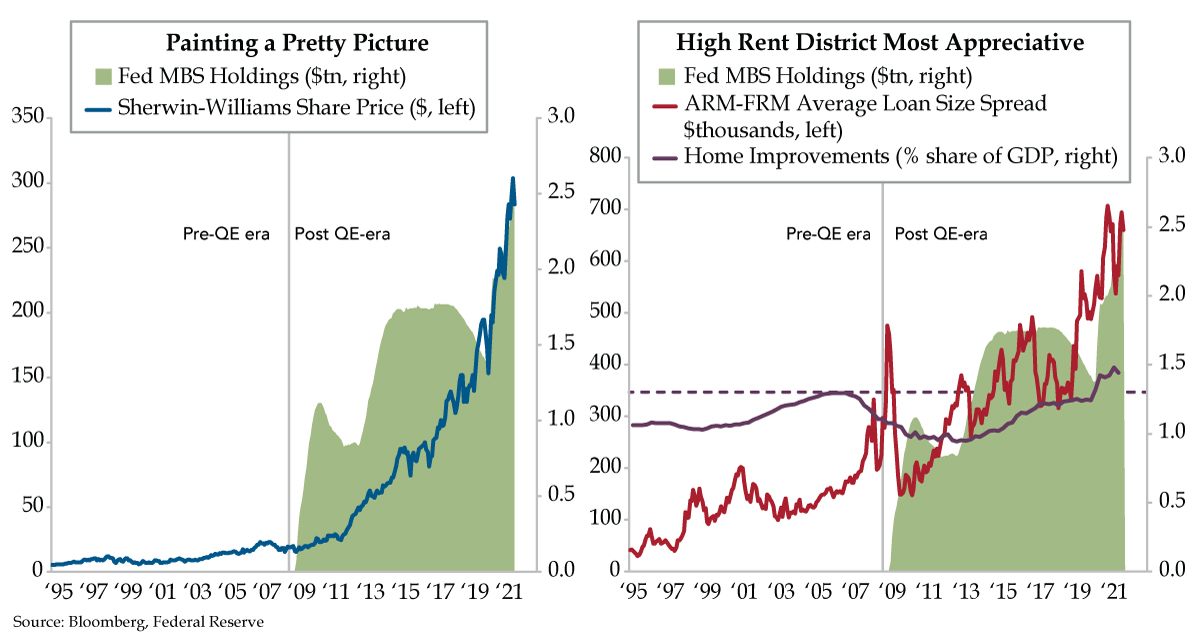

- The average mortgage loan size for adjustable-rate mortgages totaled $977,400 in September, $661,000 higher than the $316,400 for fixed-rate mortgages; this spread was roughly $200,000 in 2008 before QE began and higher-priced homes saw faster price appreciation

- As a share of GDP, home improvements have hit record highs of 1.4-1.5% post-pandemic, exceeding the 1.3% not surpassed since the series’ inception in 1959; multi-generational households have become more common as would-be new buyers have been priced out