VIPs

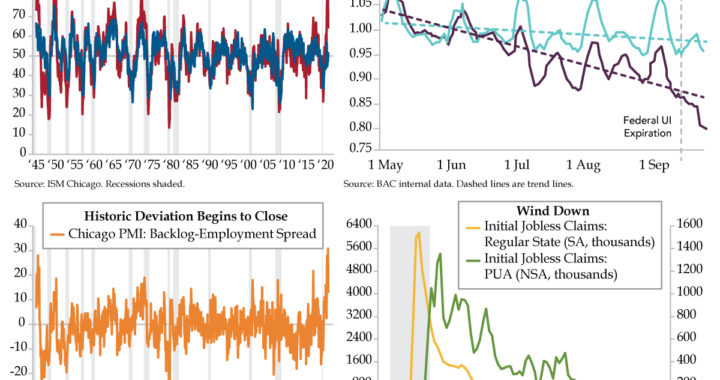

- Though the child tax credit has boosted spending through a $550 monthly boost, BofA credit card data suggests the unemployed cohort is pulling back; though a backlog is likely keeping PUA claims elevated, the cohort has nearly vanished from their May peak of 1.35 million

- Weekly initial state jobless claims have now risen for three straight weeks, a streak not seen since April 2020; a model from the St. Louis Fed using data from Homebase suggests that hiring could’ve been negative in September, with a seasonally adjusted decline of 810,000

- Per ISM, the Chicago PMI saw Backlogs decline in September while its Employment Index rose; the Backlog-Employment spread is now down from August’s record high of 30.8 to a five-month low of 13.1, an encouraging sign that the labor shortage is starting to see relief

Can you imagine rubbing horsehair in between your teeth? What a distasteful thought. Thank heavens for Dr. Levi Spear Parmly for liberating our oral health with something much lovelier. In 1815, the New Orleans dentist and author of A Practical Guide to the Management of Teeth invented a thin, waxen silk thread to help his grateful patients clean between their teeth. All of that fresh breath emanating from the French Quarter was a minor sensation, sweeping the country. Commercialization was inevitable. In 1882, the Codman and Shurtleft Company began to manufacture unwaxed silk dental floss. Why a patent was not secured is a mystery. New Jersey-based Johnson & Johnson tended to that task for its own benefit some 16 years on patenting a dental floss made from the same silk materials doctors used to stitch up boo-boos, big and small. The pesky tendency of silk to shred brought about the biggest innovation – nylon, which was conveniently waxed to ease the process.

Today, most of us Glide through this necessary routine to remove plaque from places our toothbrushes can’t Reach, thus preventing the buildup bacteria that wears on your teeth’s enamel and can even end in gum disease, which has to be ickier than horsehair. On the subject of horses…U.S. politicians are once again at a stalemate about the nation’s unhealthy buildup of debt, which financial dentists attest can culminate in the loss of reserve currency status. We wish we could say that nobility or integrity was driving the GOP to insist the Democrats “own” the nearly $7 trillion in debt that’s racked up since July 2019. But the fact is, there’s no lie in claiming that the two parties collectively incurred said debt.

That said, Standard & Poor’s cited the entitlement-debt disease when it downgraded the U.S. sovereign rating a decade ago amidst another debt limit skirmish. Though markets pitched a fit at that surprise, the only thing (largely unfunded) entitlement debt has done since is grow. And the GOP has a point in saying that raising the debt limit for the 79th time since 1960 will glide path passage along strict party lines of a $3.5 trillion social spending bill that, depending on whether it’s the Congressional Budget Office or Office of Management and Budget doing a rudimentary scoring of the bill could cost $5 billion or as much as $5.5 trillion over 10 years. And as every American voter knows, social spending programs, once enacted, never find their way to a grave.

If nothing else, there was some legislating on the Hill Thursday – the government shutdown was averted in the nick of time. Because most of the social spending and hard infrastructure bills are spread out over so many years, the only direct impact passage would have is making permanent cash payments of the child tax credit, which is estimated to have sent $50 billion to U.S. households since mid-July. That one line item in the proposed spending bill is $1.1 trillion. Revelations that Joe Manchin is on board for a much-slimmed down $1.5 trillion package suggest the credit in its current form would not survive.

The good news for consumption is that the average $550 monthly household budget booster via the tax credit is padding the effect of veering over the fiscal cliff. Per proprietary data via Bank of America, “the bad news is that the unemployed cohort is pulling back on spending owing to the expiration of federal unemployment insurance, particularly for the lower income cohort” (upper right chart). Thursday gave us the first glance of what the unemployment insurance ranks will soon be. Presumably, a backlog of claims to be processed is holding up the number of Pandemic Unemployment Assistance applicants (green line) given the program expired three weeks ago. But they’ve nearly vanished in the context of their May weekly peak of 1.35 million.

While state initial unemployment benefits are a pittance of their post-pandemic highs, it is notable that we’ve seen increases for three weeks running, a stretch we’ve not seen since April 2020. According to the St. Louis Fed, something could be amiss in the job market. Using scheduling software company Homebase real-time data, September hiring “could be weak or even negative in September.” Without seasonal adjustment, Homebase’s estimate is a decline of 500,000; the seasonally adjusted decline could be 810,000. While there’s “a lot of uncertainty around these figures,” the model has tracked data “quite well” through the summer.

You would have thought markets would have celebrated the implication that Jerome Powell will be quick to pull any tapering plans if such a print materializes. It’s evident, however, that the dissension within the ranks of the Democratic party preventing a Thursday vote on the bipartisan infrastructure bill and the prospect that the government could run out of money in 17 days, were perceived as a bigger threat to historically highly valued risky assets.

Overlooked in Thursday’s data were declines in the Chicago PMI backlogs (red line) and a rise in its employment index (blue line). The concerted moves pulled down the Backlog-Employment Spread from August’s record high 30.8 to a five-month low of 13.1 last month. It would appear Chi-town firms are finally able to start whittling down their logjammed inboxes by stocking up on staff, a promising sign that the labor shortage is starting to abate. With any luck, next on the docket is addressing the shortage of fiscal prudence inside the Beltway.