QI Takeaway — Supply chain disruptions and exogenous depressants to labor force reentry have catalyzed a debt grab at the same time cash flow issues are surfacing. More supply of credit yet will be needed for companies to operate under these conditions. A continuation of credit spread widening is to be expected, especially for industries with the most exposure to supply chain volatility.

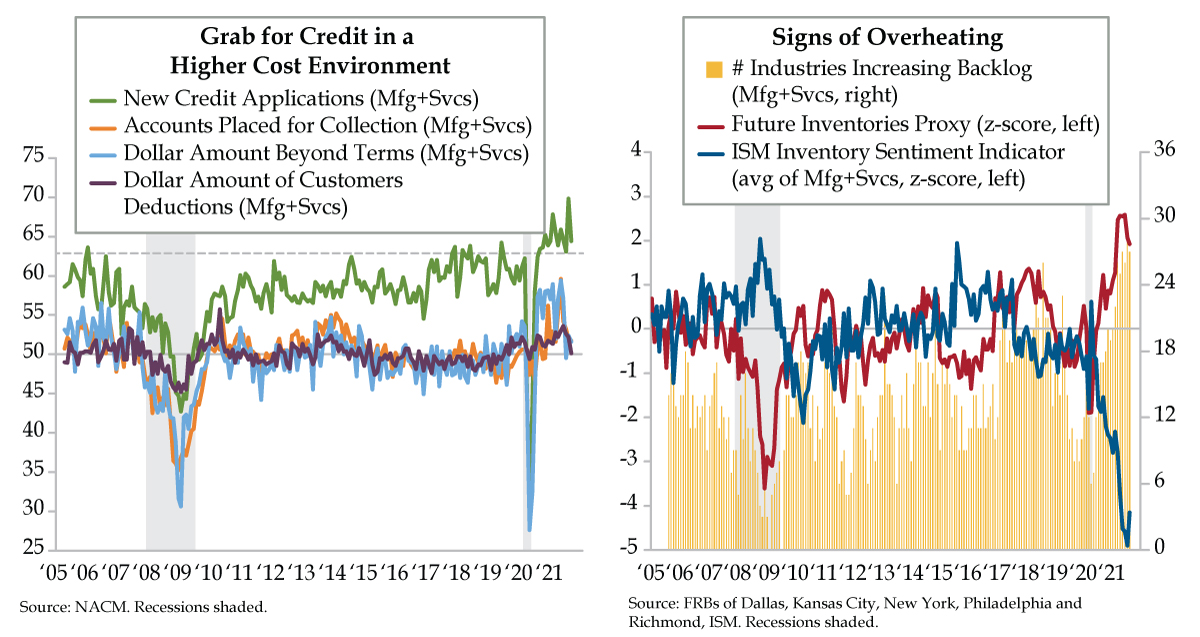

- At 63, the NACM has seen a higher post-pandemic floor for New Credit Applications as firms hedge by levering up;meanwhile, at 51.7, Accounts Placed for Collection is at a six-month low while Dollar Amount Beyond Terms, at 51.6, is the second lowest post-lockdown

- As z-scores, ISM’s Inventory Sentiment Indicator is near historical lows while the Future Inventories Proxy, based on regional Fed data, remains high; backlogs show a historic breadth of shortages across industries, supporting firms’ willingness to stockpile and add debt

- Some investment banks are forecasting a jump in investment grade issuance above $140 billion in September, well above August’s $90 billion; as for high yield, which recently surpassed $3 trillion outstanding, bond and leveraged loans sales could breach $60 billion