QI TAKEAWAY — The cheaper volatility is, the more you should load up on it. The debt ceiling is anything but “resolved” and the Fed is backed into its tightest corner ever as it’s not traditionally eased or tightened if either could be construed as playing politics.

- Mitch McConnell has agreed to go along with raising the debt ceiling by $480 million, keeping things open through early December; while this gives time for Democrats to raise it again through reconciliation, negotiations between party factions remain a roadblock

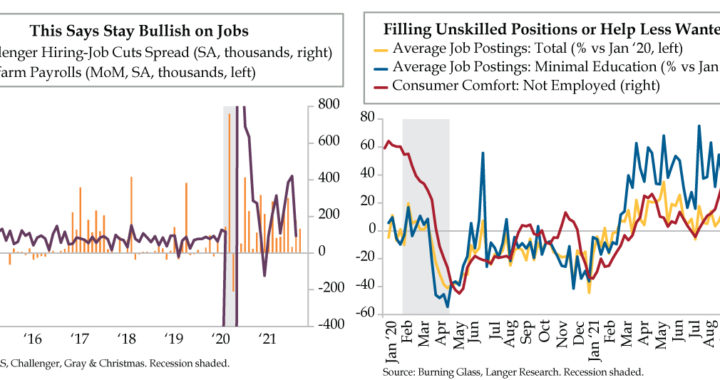

- Challenger’s Hiring-Layoff announcement spread remains robust, and the series’ correlation with nonfarm payrolls suggests a September gain near the consensus 500,000; however, strength could put added pressure on Powell at his November presser to announce tapering

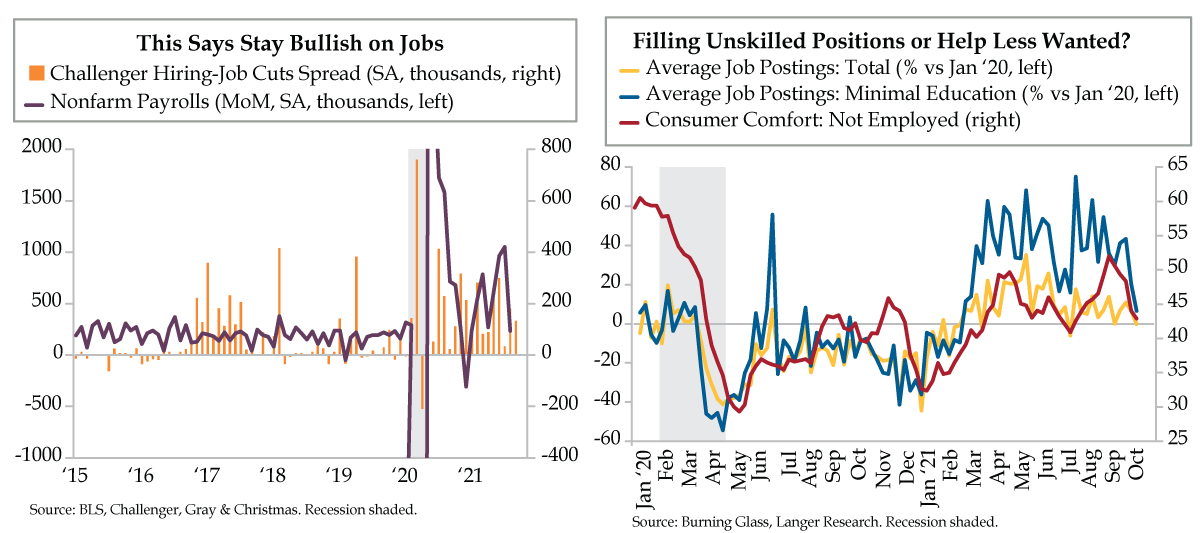

- Per Burning Glass, nationwide job postings have slipped into negative territory vs. January 2020 levels for the first time in three months; meanwhile, job postings requiring “Minimal Education” are up just 6.5%, the lowest print since February and well off May’s 68.2% peak