QI TAKEAWAY — The disconnect between ex-energy commodities, the dollar and the real global economy is becoming more apparent as signs of a spreading slowdown proliferate. The lack of Fed tools to address stagflation should cap long-maturity rates as policy errors, plural, get priced into risky asset prices.

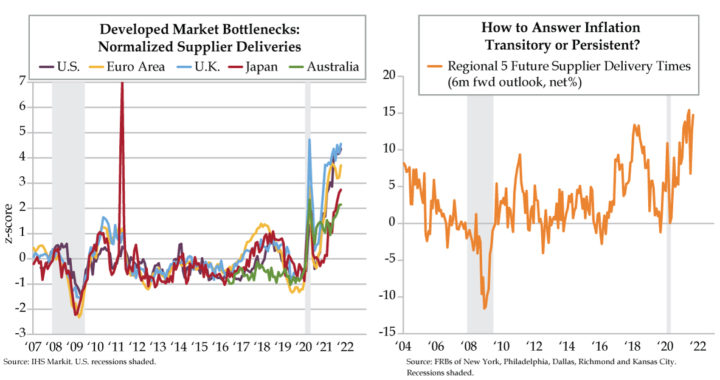

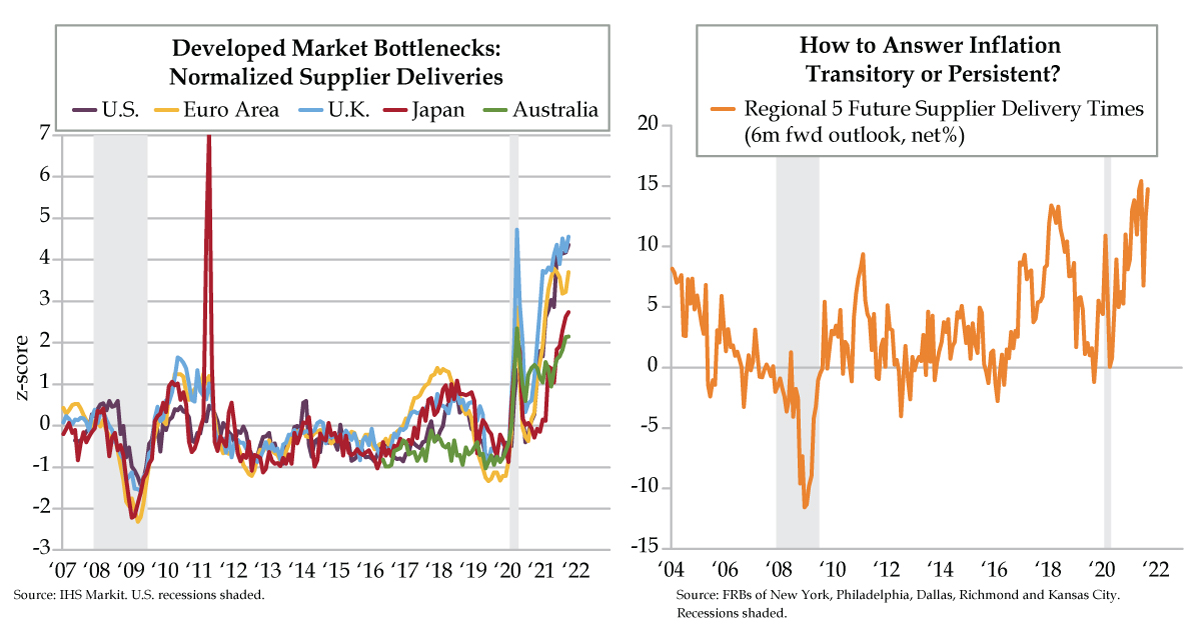

- Though Australia’s Supplier Deliveries are at record highs, they remain below the rest of the developed world; in the U.S., should there be strike threats at the ports of Long Beach and LA following the 90-day surge, regional delivery time expectations should remain elevated

- Production-related factors contributed just +0.11 to the Chicago Fed’s National Activity Indicator in August vs. +0.40 in July; though the Fed may be forced to accelerate tapering should the supply chain push up prices, tightening into a slowdown could prove devastating

- Despite low supplies, copper’s drop last week was the largest in four months, validating the fast-spreading industrial slowdown; meanwhile, bottlenecks continue to threaten earnings prospects, as only two of eleven S&P 500 sectors have seen EPS forecasts rise in October