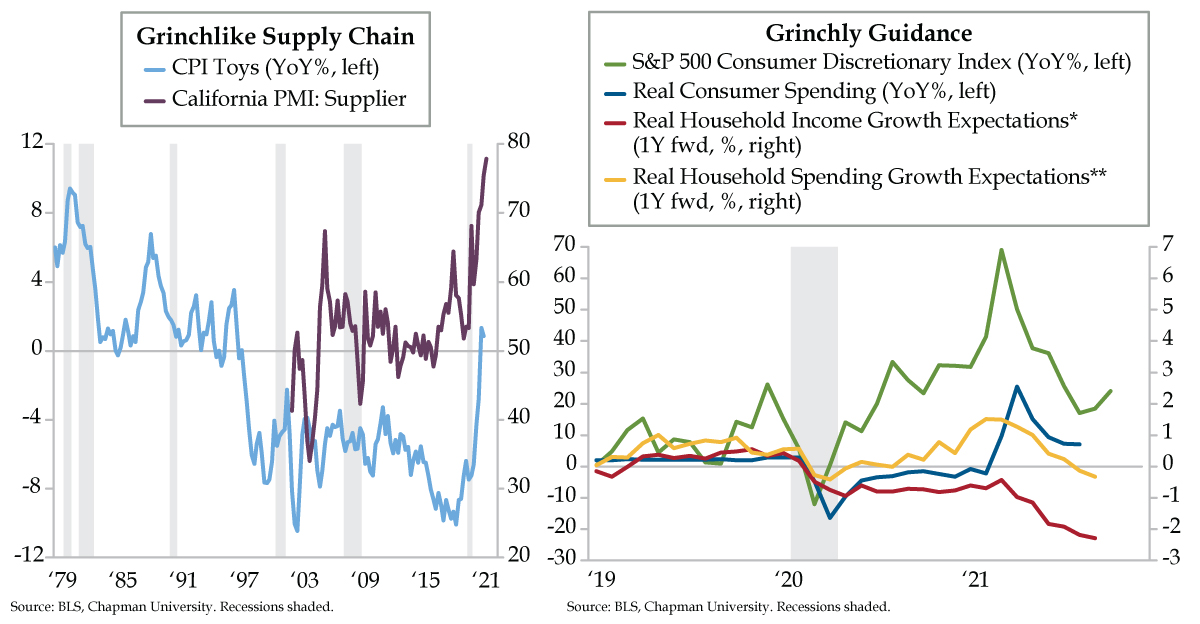

QI TAKEAWAY — Toy inflation is direct byproduct of the challenging supply chain environment. Industry sources pushing a buy-now mentality before the holidays equates to validating of higher inflation psychology. More broadly, inflation expectations are taking a toll on income and spending expectations. The bearish guidance, augmented by the 2011 debt ceiling standoff precedent, suggests staples are the better option if you have consumer sector exposure.

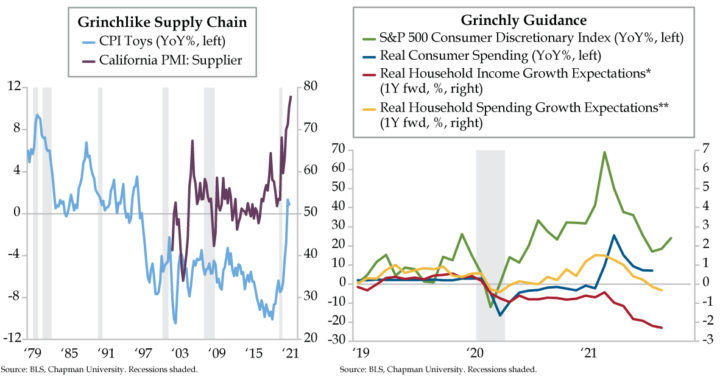

- The second and third quarters of 2021 saw CPI for toys post positive YoY prints for the first time since Q4 1996 and Q1 1997; California PMI Supplier Deliveries Index should continue to surge into Q4, with Chapman University expecting times to slow at a record high rate

- Cox Transportation recently announced that shipments have declined by nearly 5% as a result of supply chain issues; coincidentally, the only bright spot in August’s job openings data was in trade/transportation/utilities, with all other major sectors seeing declines

- In the NY Fed’s Survey of Consumer Expectations, household income growth and spending expectations both turned negative in August and September; this poses downside risk for real consumer spending, with the consensus at 2.1% and 4.2% for Q3 and Q4, respectively