QI TAKEAWAY — As the economy continues to flag late cycle and slow, Jay Powell hopes the realities of pinched budgets will force more workers back into the workforce and ease wage inflation. The scarring in the labor force combined with automation suggests otherwise. Even if there’s upside to today’s nonfarm payrolls, a flattening bias remains appropriate at this juncture.

- Unit Labor Costs saw a spike to 8.3% in the third quarter, beating out the 7.4% consensus and soaring above Q2’s 1.1% rate; while labor costs grew at their fastest pace since 2014’s first quarter, productivity moved in the other direction with a 5% drop, its worst since 1981

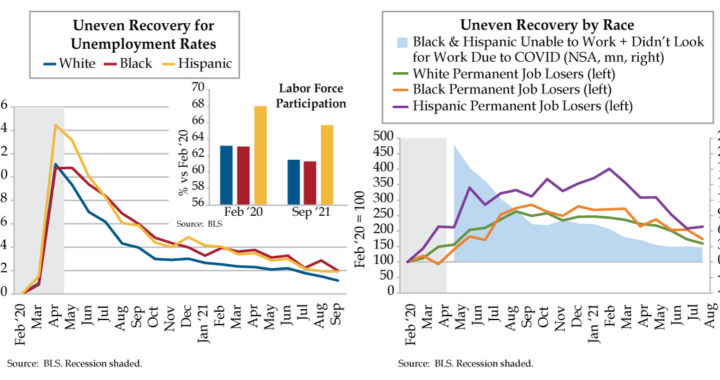

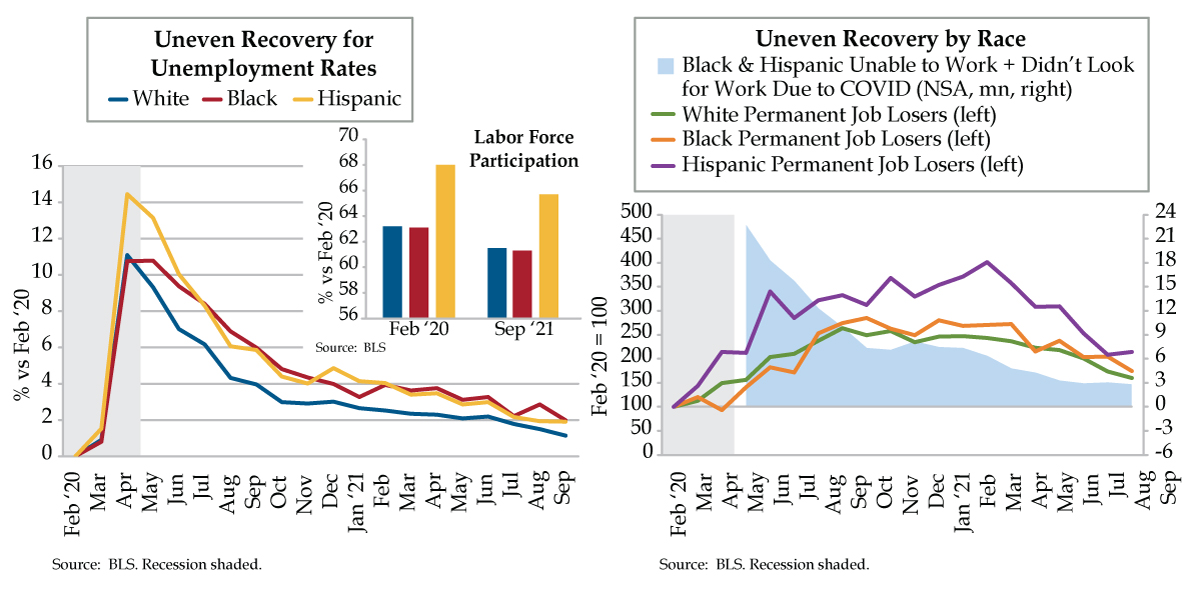

- The white LFPR has recovered to 65.7% from February 2020’s 68% vs. the black LFPR falling from 63.1% to 61.3% and the Hispanic LFPR from 63.2% to 61.5%; 2.8 million Black and Hispanic workers still remain out of work due to COVID and rising childcare costs

- The White unemployment rate is 1.1% above its February 2020 levels vs. 2.0% and 1.9% higher for Blacks and Hispanics, respectively; with minority groups seeing higher permanent job losses as well, recovery is far from the inclusiveness Powell aspires to achieve