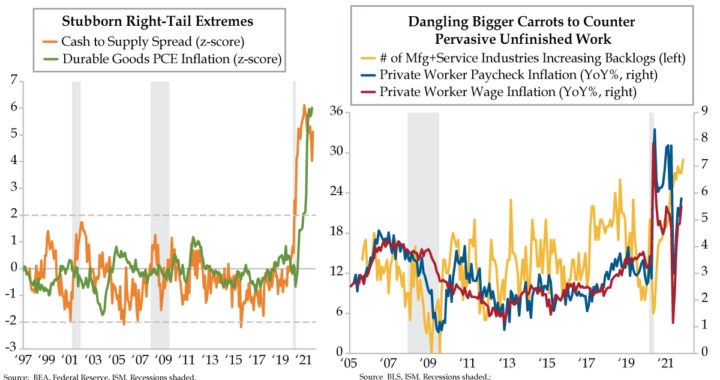

QI TAKEAWAY — Our Milton Friedman indicator continues to suggest durable goods inflation will remain persistently elevated. Wage pressures also are bubbling as backlogs have become pervasive across the economy. Short-term curve steepening is the ‘transitory’ trade post-today’s Fed meeting. But those with a flattening bias should not be deterred as Team Transitory keeps losing its fan base.

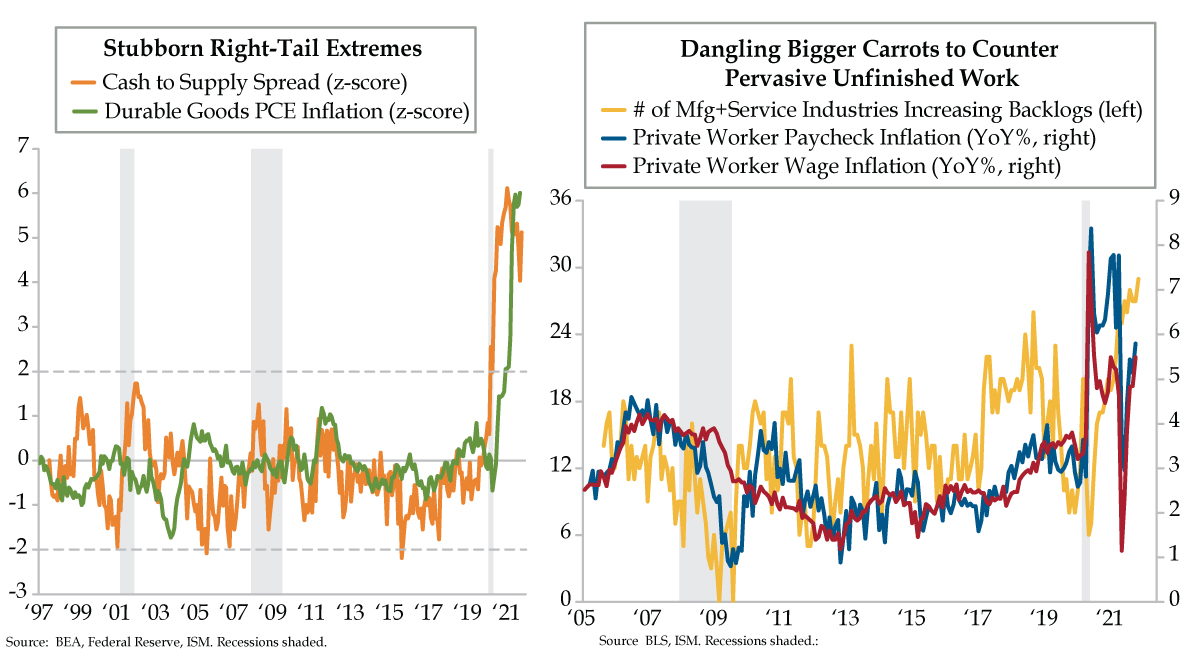

- The Cash to Supply spread, comparing cash equivalents to ISM inventories, has been above a +2 z-score for 18 months and was +5 in October; the series leads durable goods inflation, which snapped its 25-year deflationary trend last year and registered a +6 z-score this month

- Per ISM, backlogs are increasing in 29 out of 36 industries across manufacturing and services, a record high; as a result of the bottlenecks, the U.S. labor market is seeing earnings growth in the right-tail, with both paycheck and wage inflation above the 5% YoY threshold

- Yield curves steepened after yesterday’s tapering announcement by the Fed, though Powell held firm on decoupling tapering from rate hikes; however, the potential for further flattening long-term remains strong as evidence continues to defy the transitory narrative