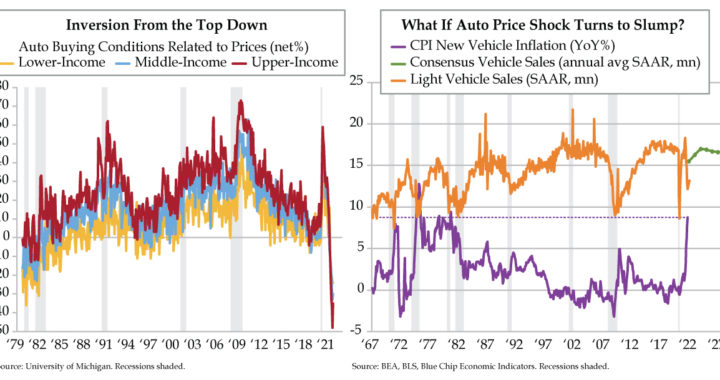

QI TAKEAWAY — Auto buying conditions across the income stack are severely challenged due to sticker shock. Notably, the biggest earners and biggest buyers are the most pessimistic. Vehicle pricing has an inverse relationship with sales over time. If the current run-up in auto inflation proves transitory, the consensus is correctly positioned with its auto sales optimism. Due to the magnitude of the demand pull forward, if the consensus is wrong, the risk is a slump in sales that would have ripple effects across the global auto complex.

- Lower, middle, and upper-income cohorts all had net pessimism regarding auto buying conditions, at -24%, -30%, and -35%, respectively, in October, per UMich; upper-income buyers have been the most pessimistic group in the last three months, not seen since 1981

- Since 1967, the correlation between CPI new vehicle inflation and new vehicle sales has been -0.47, with sales tending to rise when price rises moderated or fell; at roughly 9% YoY, current new vehicle inflation calls back to the 1970s, when sales ran at a 5-10 million SAAR

- Though October sales bounced back slightly to a 12.99 million SAAR, the downtrend since April’s 18.3 million still has room to run; the stellar bounce back to 16.3 million SAAR in 2022 is predicated on supply chains normalizing & demand not having been pulled forward