QI TAKEAWAY — China’s slowing will inevitably induce a deflationary impulse, which is on approximately no one’s radar. The urge to stay on the curve steepening trade should be resisted as this inherently reinforces curve flattening.

- China’s manufacturing PMI was 49.2 in October, just below September’s 49.6 print as energy remains constricted; crude stockpiles hit 919 million barrels by October 24, 59% of capacity and the lowest since November 2018, and 13% of coal capacity remains offline

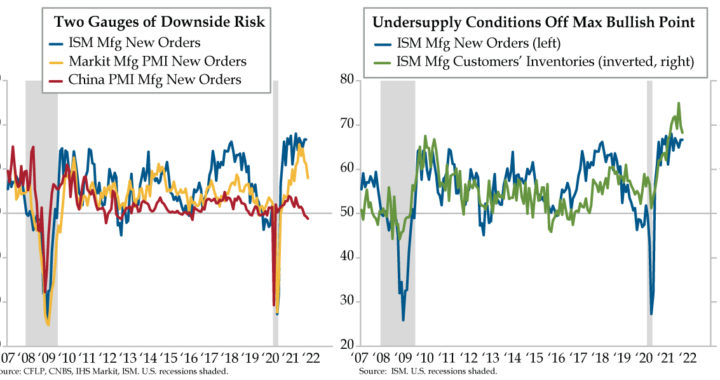

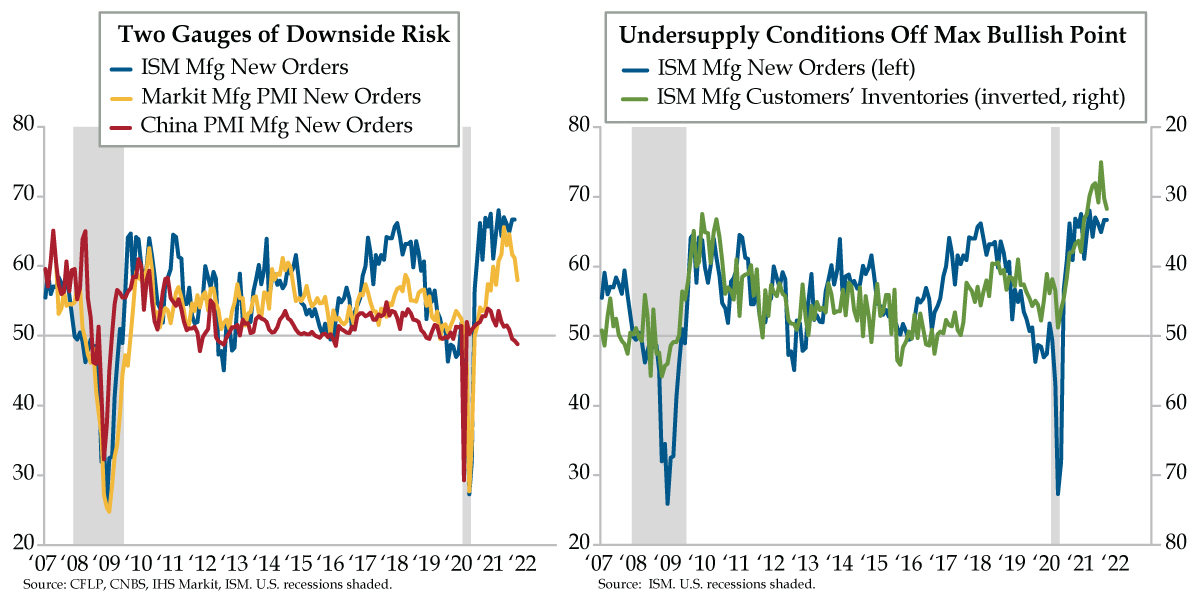

- At 31.7, ISM Mfg Customers’ Inventories are at their highest levels since February, despite lingering supply chain woes; as is the case with China, the globe’s marginal driver of demand, New Orders in the U.S., appear set to decline as inventories are replenished

- China’s services and construction PMI had a headline of 52.4 in October, shy of the 53.0 consensus forecast and well below September’s 53.2; economic activity in the world’s second largest economy is at the cusp of contracting, bringing with it a sizable deflationary impulse