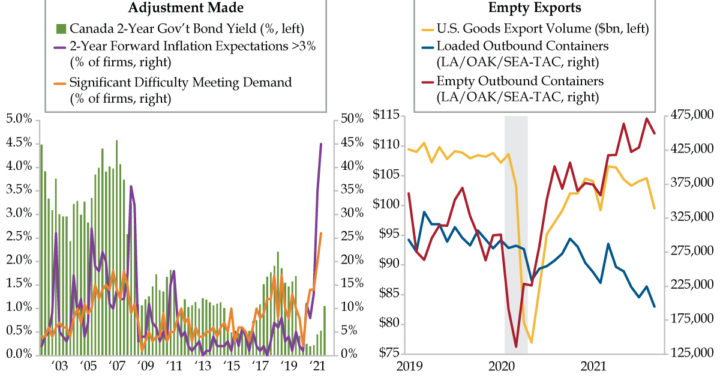

QI TAKEAWAY — The BoC launched a shock ending to QE. Short-term Canadian government bond yields reacted with a violent repricing. While persistent inflation risk was behind the BoC’s pivot, a disappointing U.S. GDP report could create a slowdown narrative which generates calls that the sell-off in Canadian government bonds could be overdone.

- The Bank of Canada ended its QE program yesterday, causing a 26 bap jump in the two-year yield in the first twenty minutes after the announcement; after ending Q3 near 50 bps, two-year yields broke the 1% barrier as the BoC let the rate volatility genie escape from the bottle

- In the BoC’s Q3 Business Outlook Survey, 26% of firms cited difficulties meeting demand, a record high, on account of supply chain issues and a shortage of labor; meanwhile, roughly half of Canadian businesses expect inflation to be at least 3% over the next two years

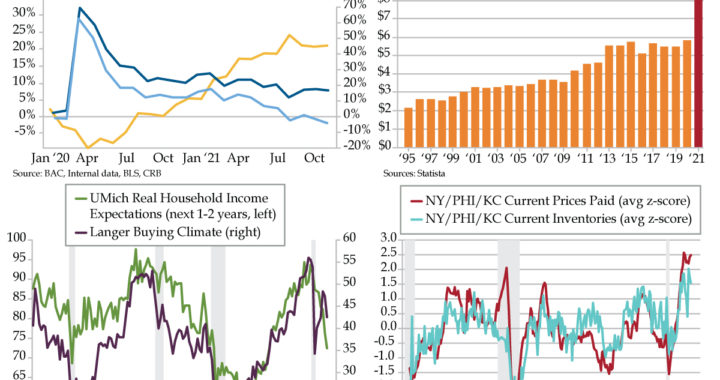

- IHS Markit predicts Q3 U.S. GDP growth of 1.6% vs. the 2.6% consensus, with inventories driving the entire gain; trade data feeds this development, with goods exports falling by 5% MoM in September and more empty containers leaving West Coast ports than full ones