VIPs

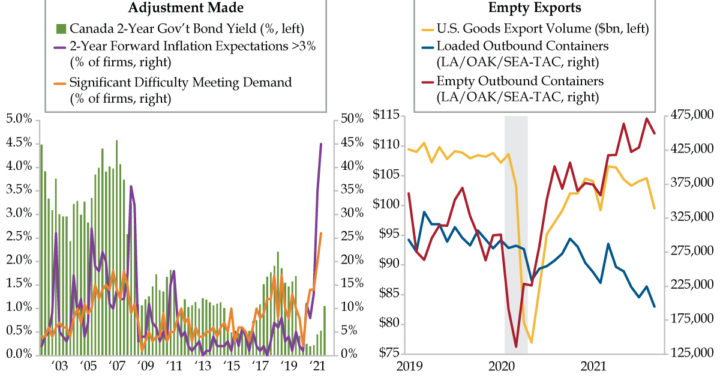

- The Bank of Canada ended its QE program yesterday, causing a 26 bap jump in the two-year yield in the first twenty minutes after the announcement; after ending Q3 near 50 bps, two-year yields broke the 1% barrier as the BoC let the rate volatility genie escape from the bottle

- In the BoC’s Q3 Business Outlook Survey, 26% of firms cited difficulties meeting demand, a record high, on account of supply chain issues and a shortage of labor; meanwhile, roughly half of Canadian businesses expect inflation to be at least 3% over the next two years

- IHS Markit predicts Q3 U.S. GDP growth of 1.6% vs. the 2.6% consensus, with inventories driving the entire gain; trade data feeds this development, with goods exports falling by 5% MoM in September and more empty containers leaving West Coast ports than full ones

Chiropractic medicine began in 1895 when Daniel David Palmer of Iowa, a teacher and grocer turned magnetic healer, performed the first chiropractic adjustment. Palmer believed that adjusting the spine was the cure for all diseases for the human race. His first patient was a partially deaf janitor named Harvey Lillard. While Lillard was working with his shirt off in Palmer’s office, Lillard bent over to empty the trash can. Palmer noticed that Lillard had a vertebra out of position. He asked Lillard what happened, and Lillard replied, “I moved the wrong way, and I heard a ‘pop’ in my back, and that’s when I lost my hearing.” Palmer, who was also involved in many other natural healing philosophies, had Lillard lie face down on the floor and proceeded with the adjustment. The next day, Lillard told Palmer, “I can hear that racket on the streets.” Two years later, Palmer opened a chiropractic school.

Spinal adjustments have been going on ever since. Metaphorically speaking, the Canadian government bond market surprised the world with an unexpected visit to the chiropractor yesterday. The doctor’s address is 234 Wellington Street, Ottawa, Ontario. If you can’t place the location, it’s where Tiff Macklem moonlights as a chiropractor from his day job as Governor of the Bank of Canada (BoC).

In a shock move Wednesday morning, the BoC ended its quantitative easing (QE) program and shifted to reinvestment mode to maintain its balance sheet assets. This hawkish act generated a 26-basis point intraday increase in the Canadian two-year yield in the first twenty minutes after the 10:00 a.m. announcement. The last time there was an uptick in two-year yields of this magnitude was October 2009 when the Canadian economy was emerging from the Great Recession. Two-year yields ended the third quarter around 50 basis points (green bars) and broke through 1.00% in yesterday’s trading session. The BoC let the rate volatility genie escape from her bottle.

Tiff, why the adjustment? BoC projects the output gap will close sooner than anticipated. In July, it called for economic slack to be absorbed in the second half of 2022. This forecast was moved forward to anticipate closure in the middle quarters of next year. As an inflation targeting central bank, the statement also was central to the hawkish pivot (bolding ours): “The recent increase in CPI inflation was anticipated in July, but the main forces pushing up prices – higher energy prices and pandemic-related supply bottlenecks – now appear to be stronger and more persistent than expected.”

Three months ago, we published the left chart. Today seems an appropriate time for an update. For the output gap discussion, there’s persistence in firms facing significant difficulty meeting an unexpected increase in demand, so much so it rose to 26% in the third quarter, a fresh high (orange line). The BoC third-quarter Business Outlook Survey (BOS) noted that this was broad based across sectors and regions with the exception of the Prairies. BoC also explained that two important supply issues — supply chain disruptions and labor shortages — were driving the capacity constraints.

For the inflation debate, shift your focus to the purple line. According to the BOS, almost half of Canadian businesses now expect inflation to be above 3% over the next two years, with most anticipating it will be between 3% and 4%. Firms with inflation expectations above 3% frequently cited supply chain disruptions, fiscal and monetary policy stimulus and recent increases in food and energy prices supporting their elevated – and above target – expectations.

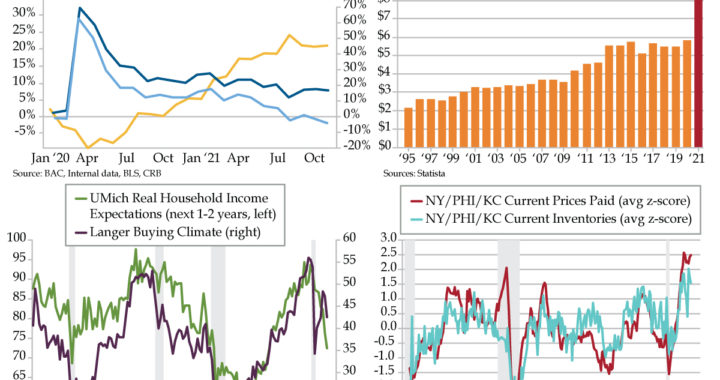

Timing of the BoC move came one day before the U.S. reports its first look at third-quarter gross domestic product (GDP). Going into today’s release, the experts at IHS Markit, who earn their keep making accurate, real-time GDP estimates, anticipated growth of 1.6%, a full percentage point disappointment versus the 2.6% consensus.

The headline number is not where the real story lies. The key aspect of today’s GDP will be the composition between demand and supply, something we flagged three weeks back. Per IHS’s math, there’s a decent chance that final sales (GDP less inventories) now CONTRACTS in the summer quarter and that inventories account for more than the entire GDP gain.

Yesterday’s advance international trade data fed this development. As seen in the right chart, the volume of goods exports appears to have declined by nearly 5% month-over-month in September, dragging the full quarter down by an annualized 7% sequential rate. We include two other series from three Pacific Coast ports to illustrate a point. More empty containers are being exported from Los Angeles, Oakland and Seattle-Tacoma (red line; Long Beach not included because it doesn’t break out outbound empties) than those that are fully loaded (blue line). Until it’s less profitable to ship empties to China, this technical factor is likely to act as an impediment to U.S. export growth.

Whether fundamental or technical, there’s a Pavlovian Street response to unfavorable mixes for near-term growth prospects. As the lightning flattening of the yield curve broadcasted, a chiropractic downward adjustment to fourth-quarter U.S. GDP by the entire forecasting community is in the offing. For the short-run Canadian dollar outlook, slowdown risk from the U.S. would be a bearish offset to the BoC’s unexpected pivot which is advertised as a bullish development. Because of these cross currents, we wouldn’t be surprised if sell-side rates strategists started chirping “overdone” for the sell-off in government of Canadian bonds.