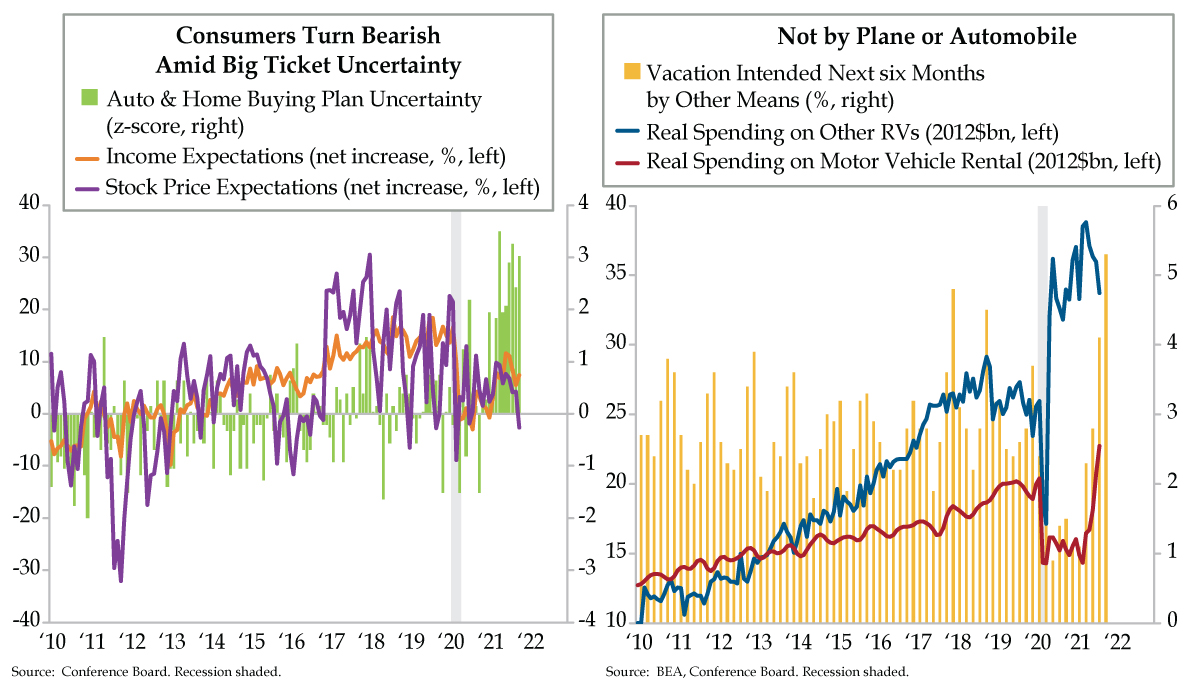

QI TAKEAWAY — Bearish signals on the stock market, cooling income expectations and auto and home buying uncertainty outweigh positive travel trends. For those with portfolio holdings in RV companies, such as high-flyers Thor and Winnebago, that have seen double-digit annual stock price gains, cashing in some chips might be a prudent course of action.

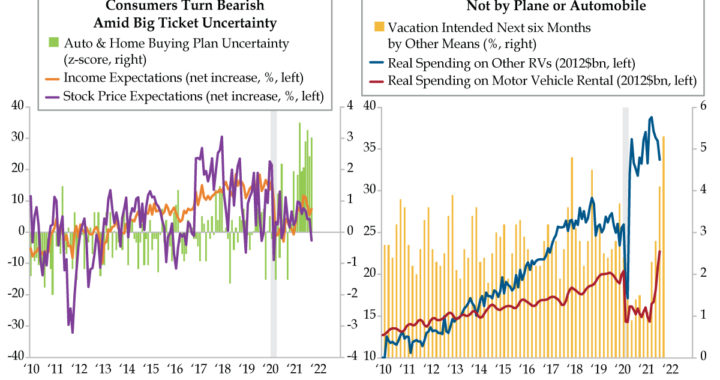

- October’s Conference Board consumer survey found 36.0% of consumers polled seeing stock declines in the future vs. 33.3% seeing stocks rising; though conviction is low, the -2.7% spread between increase and decrease was the first bearish signal since July 2020’s -1.8%

- Income expectations, which have a 0.61 correlation with stock price expectations since 1987, have also cooled slightly; meanwhile, household buying plan uncertainty for autos and homes rose above normal levels in October, on account of higher prices tempering purchases

- 47.6% of consumers signaled they intend to take a vacation within six months, the highest since February 2020’s 54.9%; Smith Travel Research data shows that intentions have been realized, with hotel occupancy growing at double-digit YoY rates for 31 weeks since March