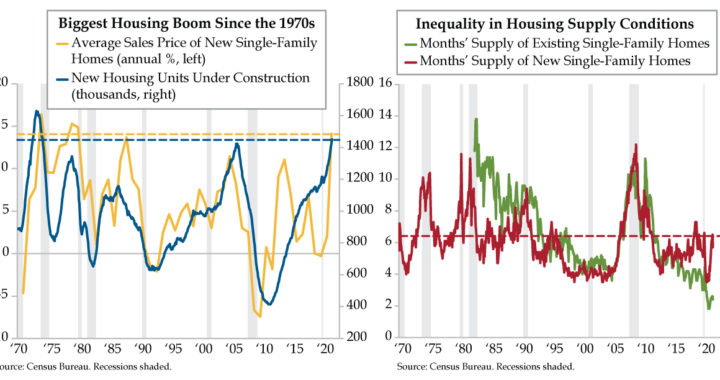

QI TAKEAWAY — Absent a post-Ida surge of auto sales, big ticket discretionary and housing remain at risk of continued weakness. We reiterate our overweight bias in Staples and add that the long-delayed household credit downturn may finally be upon us.

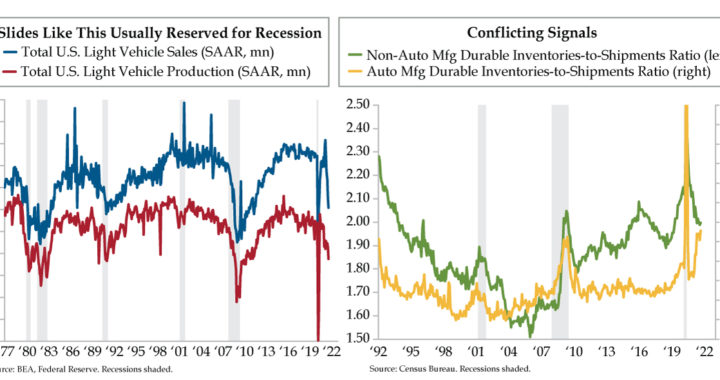

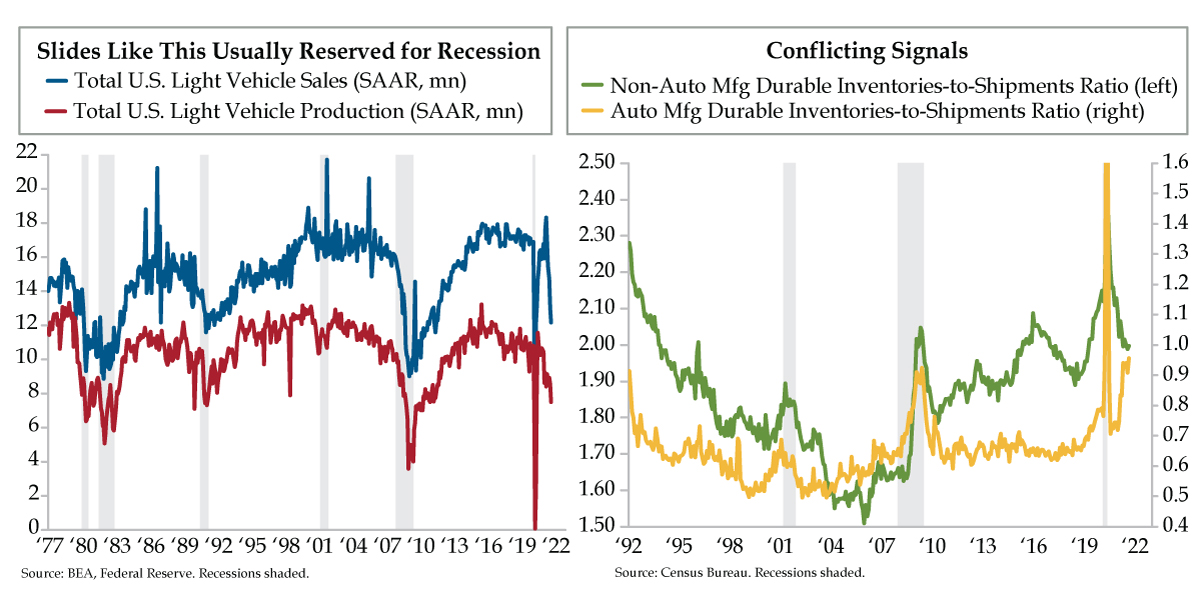

- Since peaking in July 2020 at a 11.5 million SAAR, U.S. Light Vehicle Production has fallen to a 7.5 million pace, the worst since March 2020; meanwhile, October is set to mark a 6th consecutive month of falling Light Vehicle Sales, not seen since the height of the GFC

- At 0.96, the Inventories-to-Shipments Ratio for Autos is at its highest since May 2020, while the same ratio for Non-Autos has slipped from 2.4 in April to 2.0; the latest prints of the Empire State and Philly Fed Mfg. surveys confirm a rise in inventories and urge to stockpile

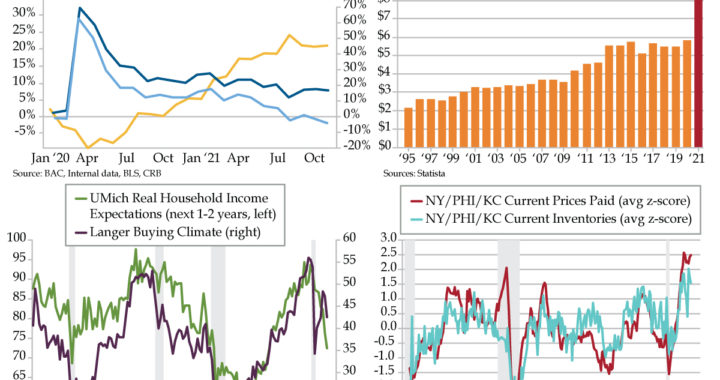

- Though Deloitte projects a 5% rise in holiday spending vs. 2020, the higher-income cohort plans to spend 15% more vs. 22% less by the lower-income cohort; absent a further stimulus injection, the threat of continued weakness remains due to demand being pulled forward