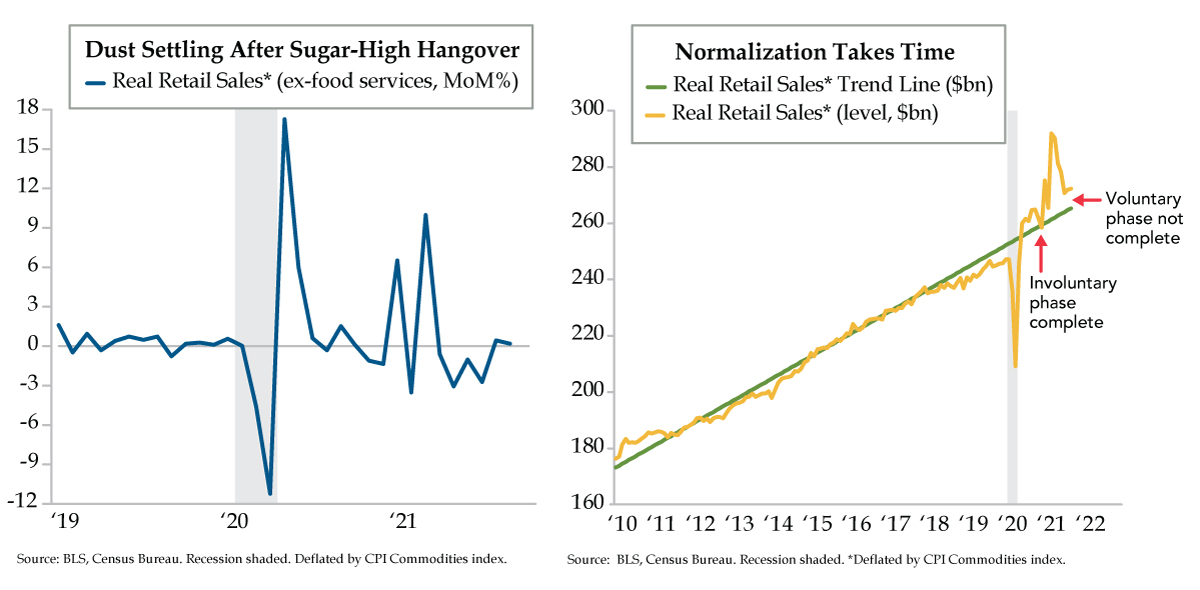

QI TAKEAWAY — There is still more normalization to trudge through on the retail spending front despite September’s upside surprise. We maintain our staples over discretionary stance in the consumer sector.

- U.S. retail sales surprised to the upside in September, seeing a 0.7% MoM gain vs. the -0.2% consensus while July and August saw a combined 0.4% upward revision; in response, equities rallied led by cyclicals, while Treasuries sold off with higher yields in 10s than in 2s

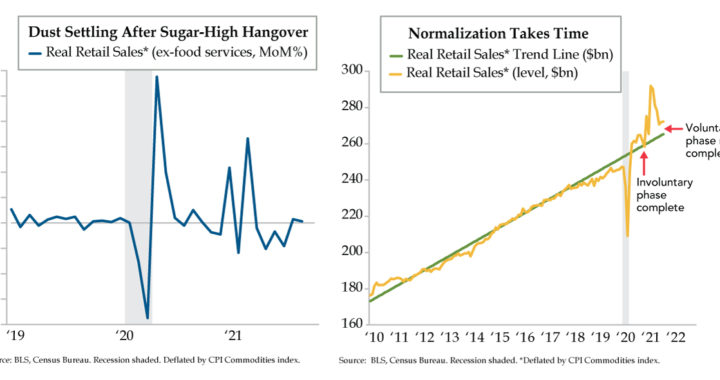

- Real retail sales, excluding food services and deflating with the CPI for commodities, saw volume gains of 0.4% MoM in August and 0.2% in September; thus, price increases drove roughly 60% of August’s headline retail sales increase and 75% of September’s advance

- Little notice was given to the downside in October’s NY Fed Empire State Manufacturing report, which saw new orders, employees, and hours worked all fall; meanwhile, UMich’s Survey of Consumers saw sentiment fall to its second-lowest level since 2011 in October