QI TAKEAWAY — Mismatches between workers and bulging backlogs herald increasing wage pressures at a time when the economy is faced with a stall in private demand. Leverage is the answer in cyclicals most exposed to these cross currents. Active credit investors should be mindful of these factors that suggest a more bearish setting regarding valuation.

- Over the last week, IHS Markit has lowered its Q3 GDP estimate (as has the Atlanta Fed), from 3.6% to 1.5%, a far cry from Bloomberg’s 5.0%; driving the downgrade is a stall in private demand, which is working against increasing government spending and inventories

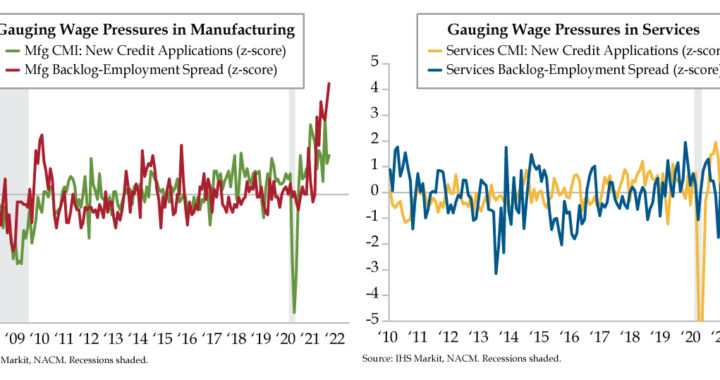

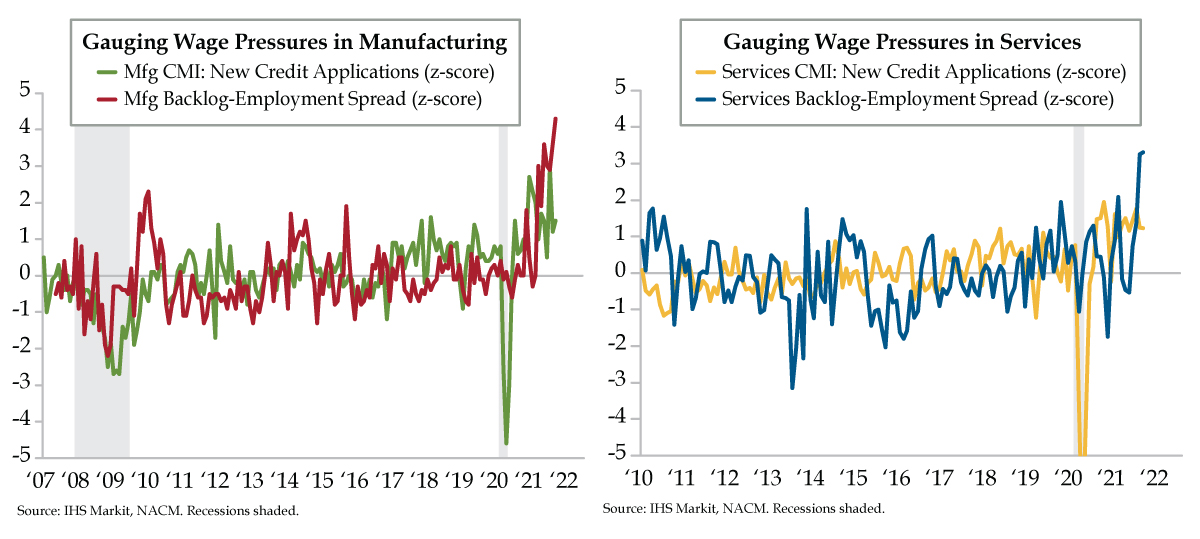

- In both the manufacturing and services sectors, the Backlog-Employment Spread, per IHS Markit, is at a historically high z-score; although both are likely to continue seeing wage pressures, the issue is most acute in manufacturing, a function of its innate cyclical nature

- The National Association of Credit Management found more firms expanding their credit lines in September in order to stockpile and address supply chain stability concerns; though higher leverage may be needed to weather higher costs, it also creates added right-tail risks