QI TAKEAWAY — We re-reiterate our call that Consumer Staples are poised to outperform in an environment in which it’s irrefutable that the majority of Americans have run dry of funds to splurge on inflation-juiced discretionary goods.

- Driven by services, consumption added 1.09 percentage points to Q3 headline GDP; goods spending, which shaved 2.3 ppts off GDP contribution to real spending, was flattered by services and non-durables, which slumped to a 5.4% QoQ pace from Q3 2020’s +25.9% print

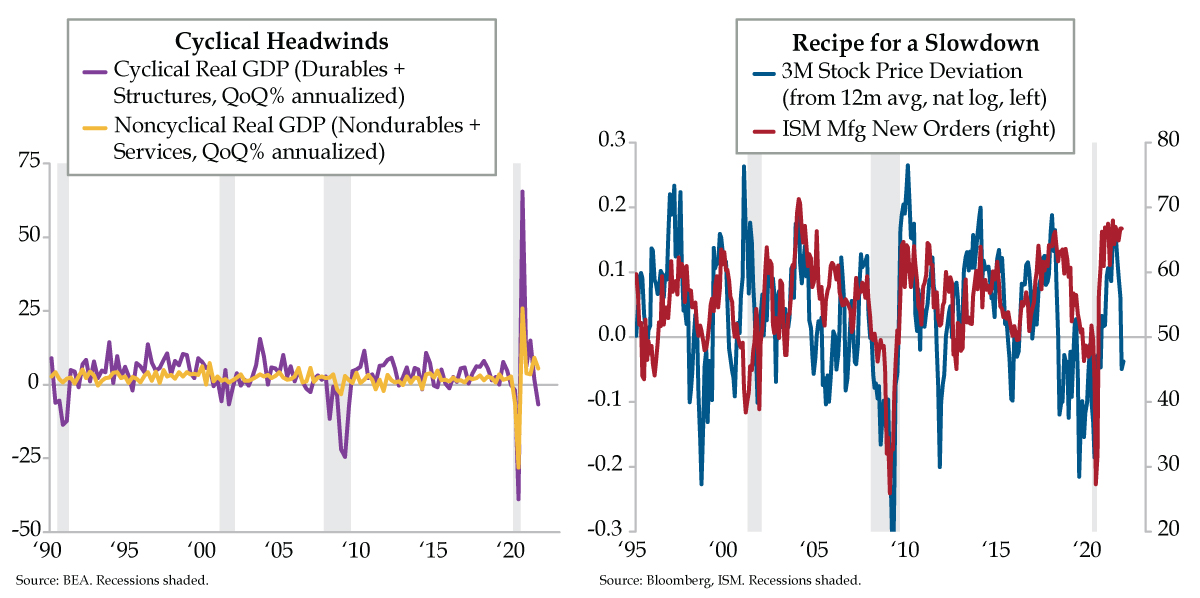

- Inflation-adjusted growth in durables and construction spend fell to a -6.8% QoQ pace in Q3, down from 2020’s 65.4% record; meanwhile, per BofA, with a 19% 2-yr growth rate that’s 6 ppts above the summer average, services spending remains driven by higher income earners

- 3M’s stock price remains a cyclical stalwart, deviating from its 12-month trend in recent years only during the Euro crisis, the mid-2010s industrials recession, and today; the stocks’ correlation with ISM New Orders suggests an unexpected downside from the latter indicator