VIPs

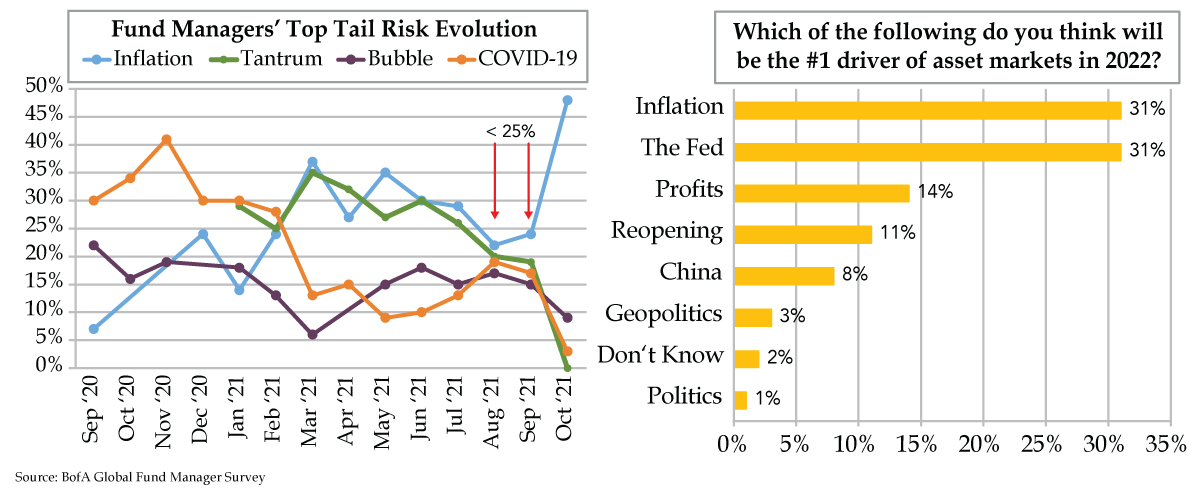

- The top four concerns in August & September’s BofA’s Global Fund Manager survey were Inflation, Tantrum, Bubble and COVID-19 – none of which got more than 25% of responses; clarity on risks emerged in October, with Inflation the clear winner at 48% and China at 23%

- At 31%, investors view inflation and the Fed as the primary drivers of 2022 asset markets; with China at a distant fifth place with 8% of responses, deflation is an underpriced risk reflected in the yuan’s appreciation to 6.3930, which defies the deflation narrative

- Per BofA, the net percent of investors expecting a steeper yield curve fell to 23% in October, the lowest since June 2019 and well below September’s 48%; though deflation is not the consensus view, opportunities exist should China tail risk probability grow in importance

Know any Rock and Roll Hall of Famers who are Nobel Prize in Literature winners? Bob Dylan is revered as one of the greatest songwriters of all time. One of his works spoke to us today. Recorded in October 1963, “The Times They Are a-Changin’” became an anthem for the era’s frustrated youth, a call to action to the anti-establishment that would earn the moniker of “hippies.” Of the song, Dylan wrote, “I wanted to write a big song, some kind of theme song, with short, concise verses that piled up on each other in a hypnotic way. This is definitely a song with purpose.” Fate being the wild card it is, less than a month after Dylan recorded the song, President Kennedy was assassinated. The night that followed that dark day, Dylan opened his set with the tune. He said that he had to sing it: “Something had just gone haywire in the country and they were applauding the song,” he recalled, and he couldn’t understand why, “it was just insane.”

The same cannot be said of the financial markets. Over the 18 months ended September 2021, the S&P 500 posted monthly gains in 14. The first two-thirds of October indicate the streak is set to extend to 15 of 19 months. It helps that investors have central banks at their backs. The Fed’s balance sheet expanded $3.2 trillion to almost $8.5 trillion from March 2020 to September 2021. A broader measure incorporating the European Central Bank, Bank of Japan, Bank of England, Swiss National Bank and the People’s Bank of China with the Fed rose $9.6 trillion to $33.0 trillion. That’s insane.

Either way, market narratives over the last year and a half have pivoted from Coronavirus topping the Wall of Worry in 2020 to this year in which Inflation and Bond Tantrum jockeying for the top spot. Observe the left chart. Number one Inflation and number two Tantrum both peaked in March and have faded through the summer months. Asset bubble, now number four, has been relatively constant, but a lesser concern. COVID-19 rose recently due to the Delta variant but stepped back in September.

Wavering conviction signals new narratives brewing. In August and September, the Bank of America (BofA) Global Fund Manager Survey revealed low conviction about the largest tail risks. Of the top four choices – Inflation (light blue line), Tantrum (green line), Bubble (purple line) and COVID-19 (orange line) – not one garnered at least a 25% share of fund manager responses. Fans of the game show Who Wants to Be a Millionaire would be familiar with this concept. When contestants use a lifeline to ask the audience and there’s no clear cut “winner” of the four choices, it’s like the masses answering, “I don’t know.”

Then October happened, and fund managers downed a tall swig of clarity. At 48%, Inflation was a clear and decisive top tail risk. The other three – Tantrum (0%), Bubble (9%) and COVID-19 (3%, lowest since the pandemic hit) – faded. Not illustrated in the left chart was the second biggest tail risk — China, at 23%. To emphasize a point, both Inflation and China were well ahead of all the remaining choices the survey record 430 panelists had to choose from. Write this down: China is a Deflationary tail risk. Evergrande surfaced, and the pace of economic growth slowed. Investors are in a classic tug-of-war set up between Inflation in the right tail and, to a lesser extent, Deflation in the left tail.

As you see on the right, Inflation is also top-of-mind for fund managers as the biggest factor for asset markets next year. Trading the dominant Inflation narrative will dictate investor positioning. In that same vein, the Fed being tethered to Inflation is synonymous with the higher short rate volatility we flagged Tuesday.

Looking down the list, China was a distant fifth. Investors believe (1) deflation will not be a significant influence next year and (2) deflation is an underpriced risk right now. The Chinese yuan’s continued appreciation through yesterday’s close of 6.3930 does not back the deflation narrative. For perspective, a greater inflationary pressure would build should the Chinese currency break below the May 28th post-pandemic low of 6.3685.

The narratives they are a-changin.’ A critical mass of investors has put Inflation at center stage. They also see inflation prescribing financial market positioning into next year. With the Fed also a main driver, it reinforces the notion of a bear flattening in the yield curve, that is, with rising short rates doing more of the work. It’s no wonder that BofA also indicated that the net percent of investors now expecting a steeper yield curve collapsed to 23% in October, the lowest since June 2019, and well south of the 48% surveyed in September.

At the highest level, to lean on a term that’s held throughout today’s missive, broad positioning is insane. “We’ll let our friend David Rosenberg’s tweet from yesterday bottom-line it “Cognitive dissonance? BofA survey shows global PMs with weakest economic outlook since April 2020 and yet they have retained a huge net overweight in the equity market — and record underweight in bonds.”

Deflation risk expressed through the China narrative that would bull flatten the yield curve is not front and center. But since deflation is not a consensus-like view, it presents “lottery ticket” opportunities for those with capacity and nimble portfolios should China tail risk probability grow in importance.