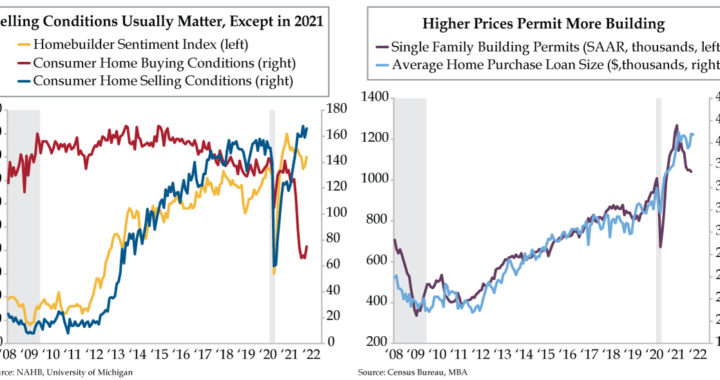

QI TAKEAWAY — Home selling conditions usually track home builder sentiment, but home buying conditions have taken the reins in a post-pandemic world. The persistence of rising home prices should keep builders building as fleeting labor market strength quells any concerns that the recent slowing is a sign of what’s to come macroeconomically. Take the ride in the sector but know it won’t last.

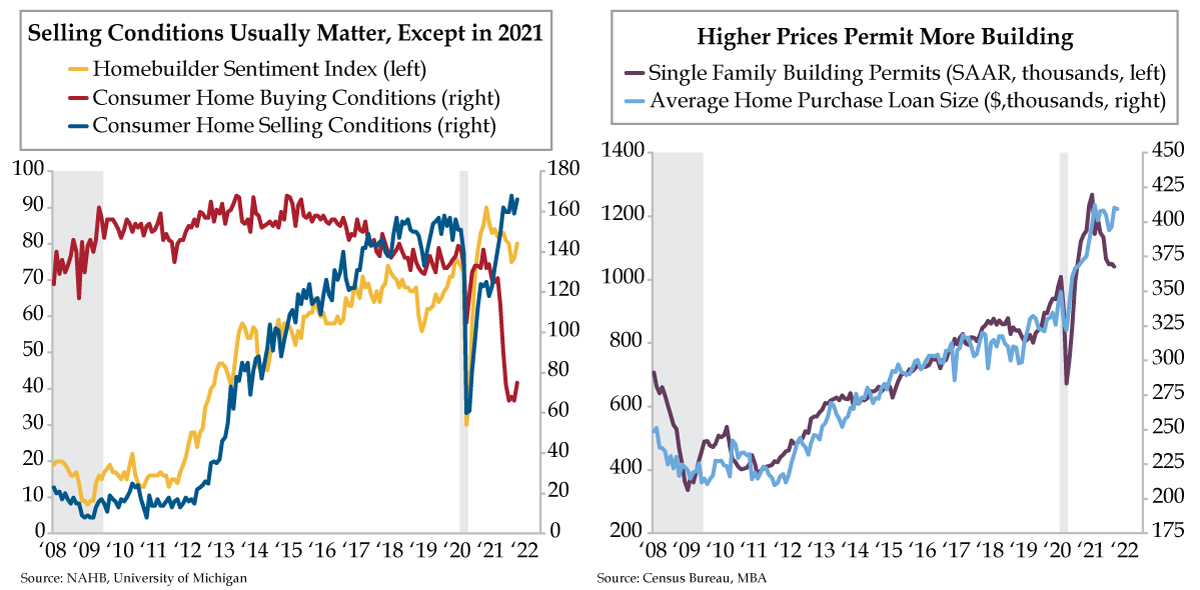

- The median price of a single-family new home rose to a record $390,900 in August, an unprecedented 26% jump from April 2020; as a result of affordability challenges, UMich’s consumer home buying conditions index has held at record levels of negativity since May

- Since 1993, the National Association of Home Builders’ sentiment index has had a 0.92 correlation with UMich home selling conditions vs. 0.08 with buying conditions; in the last 12 months, that correlation has flipped to -0.77 and 0.81 for selling and buying conditions

- Historically, the MBA’s average home purchase loan size has tracked with single family building permits; loan size appears to have stalled around $400,000, while single family permits fell back in September to July 2020 levels in the face of retracting demand