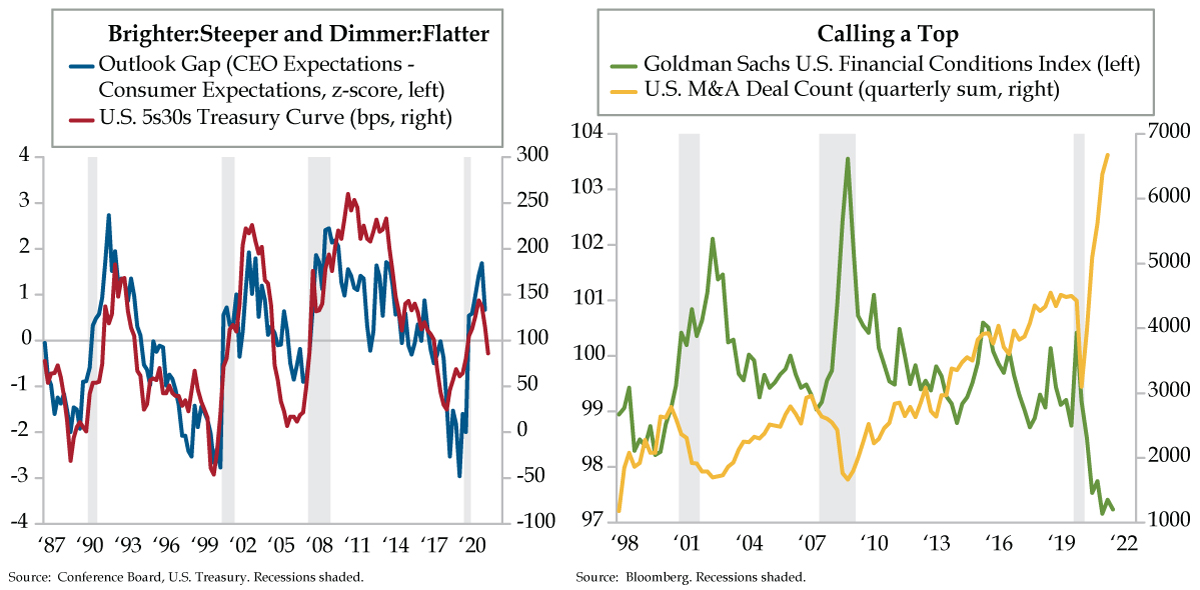

QI TAKEAWAY — The yield curve is flattening. The Outlook Gap is turning. Rate vol is rising. Tightening financial conditions would clinch an M&A top. This confluence sets up a bigger correction for risk assets in coming months.

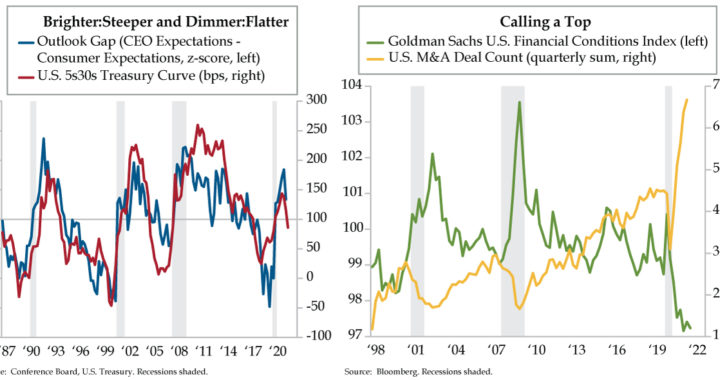

- The spread between the 5-year note and 30-year bond fell below 100 basis points over the last week, hitting 85 bps in yesterday’s trading session; after the 1990, 2001, and 2007-09 recessions, the 100 bps level served as a demarcation line from early to middle/late cycle

- As firms battle wage pressures via M&A activity, U.S. deal counts have reached successive records in Q2 and Q3; the October-to-date deal count is tracking to 2,200 by the end of the month, which would be the fourth highest on record behind September, June, and August

- As a z-score, the Outlook Gap, or spread between CEO and Consumer Expectations, looks to be coming down as it usually does when expansions mature; however, rising wage pressures remain an opposing headwind that is making consumers relatively more optimistic