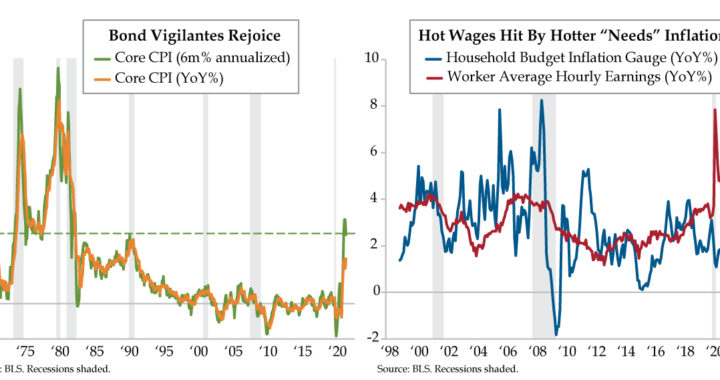

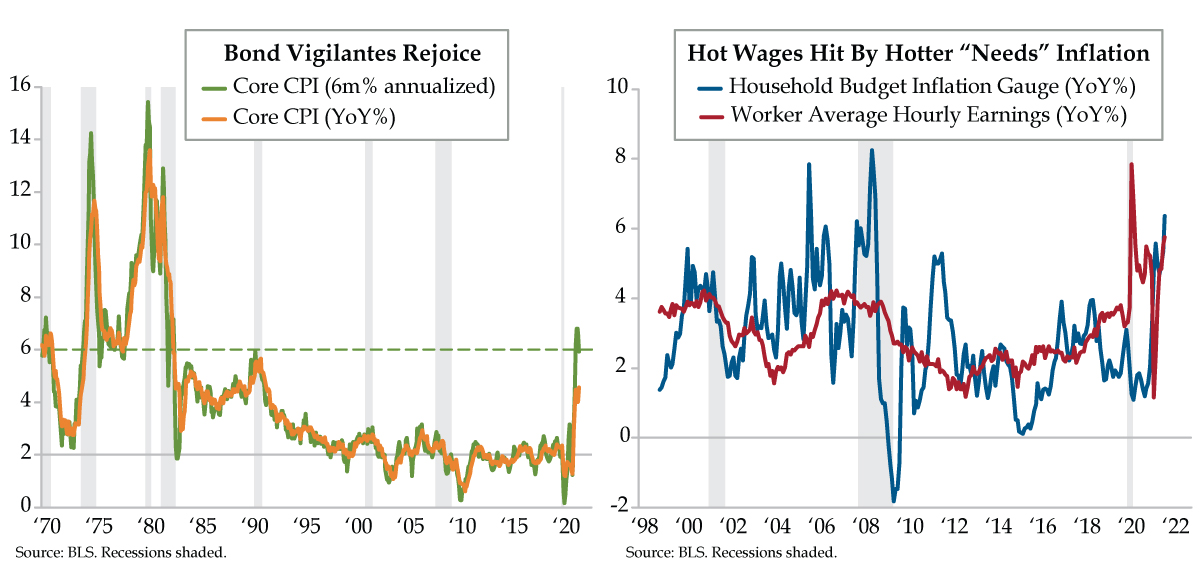

QI TAKEAWAY — The bond vigilantes were back out in force in the U.S. Treasury market yesterday. Echoes of the 1970s from the core CPI ratify the rational response from the inflation surprise. However, nondiscretionary inflation, the kind that cannot be avoided, is part of the run up – and will act as a governor on growth from the lowest rungs of the income distribution upward. Though great political optics, calls for the Fed being behind the curve might be offsides.

- Both the MoM and YoY changes in the CPI and core CPI exceeded every estimate by economists in Bloomberg’s survey; the surprise generated an up-shift in the U.S. Treasury curve, with the greatest bulging seen at the 5-yr point as the 5s30s curve flattened < 70 bps

- In the last five months, six-month annualized core CPI has run between 5.9% and 6.8%, not seen since the early 1980s; with this shorter-run trend running hotter than the YoY pulse, core CPI inflation forecasts are likely to be revised upward from the current 4.6% annual rate

- QI’s Household Budget Inflation Gauge rose to a 6.4% YoY rate in October, the highest since the Great Recession; while wages for non-manager workers has risen from April’s 1.1% to 5.8% YoY in October, the HBIG has outpaced wage gains in five of the last seven months