QI TAKEAWAY — “Transitory” inflation is now catalyzing bankruptcies in America. As much as we hear about the bravado of job hoppers, job losses necessarily follow companies going out of business. The ‘stag’ in stagflation is rearing its ugly head. We know we’ve been swimming upstream for months against the tide of buyside and sell-side steepening calls. We remain comfortable with our call.

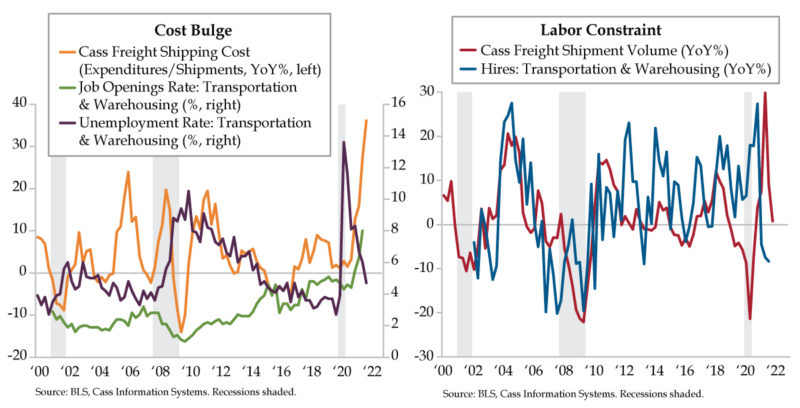

- Bankruptcy filings for companies with at least $50 million in debt hit three in the week ended November 12 vs. nearly 15 seen in June 2020; though the Fed’s credit backstop limited creative destruction, corroded supply chains are pressuring firms that survived the pandemic

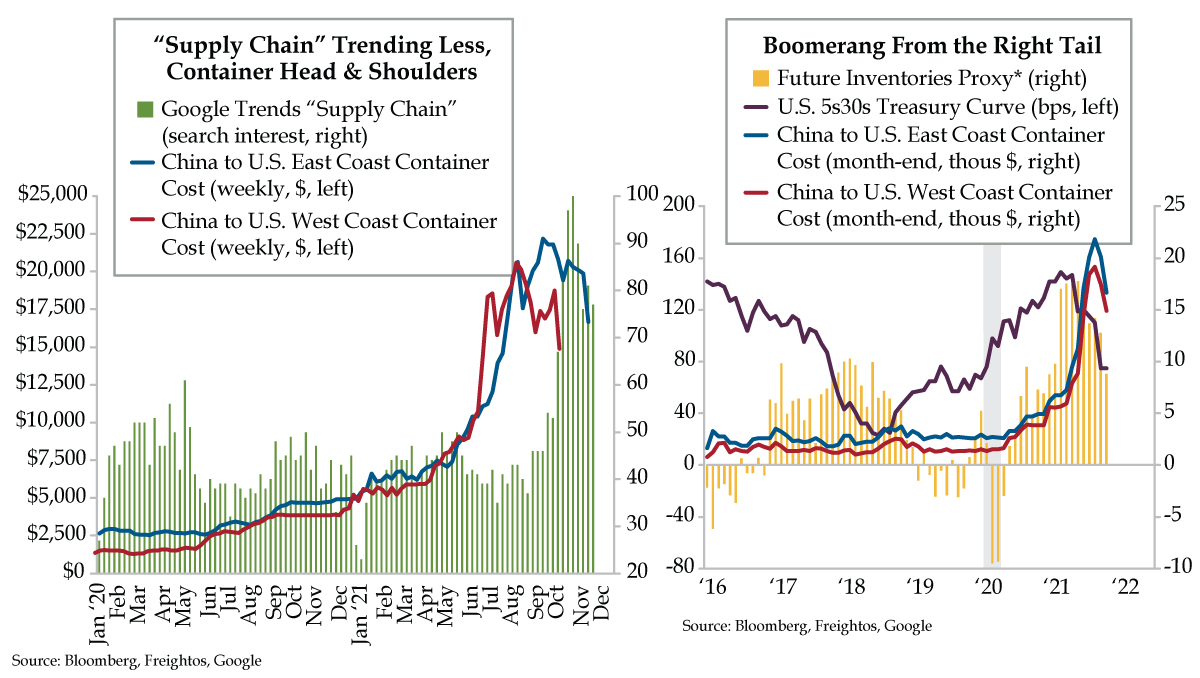

- An average of Future Inventories from regional Fed surveys suggests that panic buying by firms has subsided; the same message, which harms future GDP math, can be seen in the tightening of the 5s/30s curve corroborated by a decline in Google “Supply Chain” searches

- Per Freightos, container costs from China to the US’s East and West Coasts have finally begun to turn; should the downward trend continue, prices may begin to fall back down to Earth for consumers as well as for businesses struggling to manage elevated input costs

Intelligence Briefing Takeaway — 11.13.21

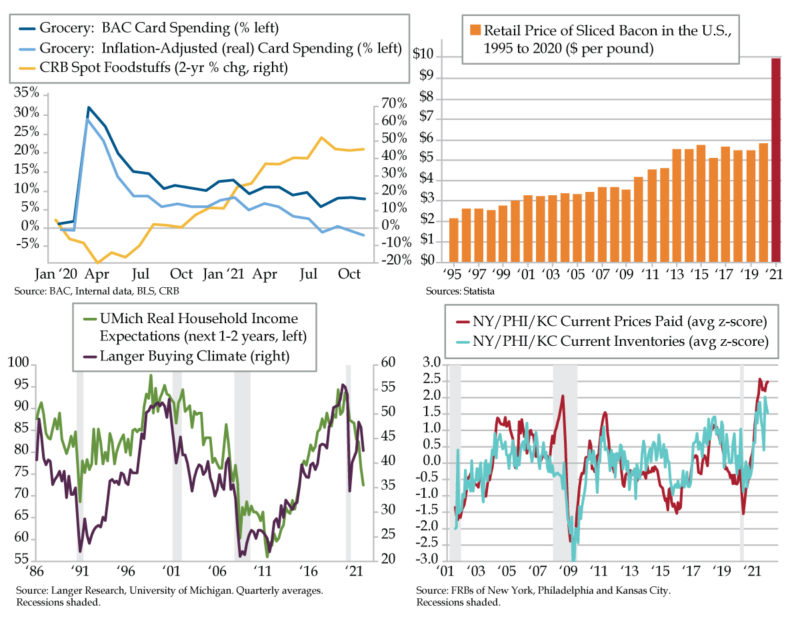

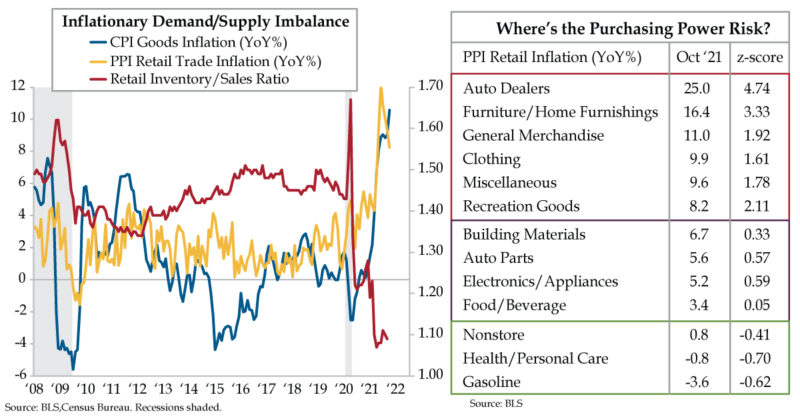

A policy error or a policy error. These are the Fed’s options – hike into a slowing economy, which under the surface of the wealthy and job-secure Americans spending like drunken sailors, is slowing without the go-go juice of stimulus and debilitating inflation or leave the punch bowl in place despite how drunk the partygoers already are on policy being too easy for too long…again. Sadly, for Powell, inventories are finally being replenished and the demand pull-forward for goods purchases is more obvious by the day. Record numbers of job-hopping workers obfuscate how badly accelerated automation has already scarred the labor force. This past week, albeit in reference to car sales, Cox Automotive’s chief economist Jonathan Smoke nicely captured the best-case scenario outcome for the Fed and the economy: “The theme of the month seems to be that conditions are getting better, or at least not getting worse.” We can only hope.

QI NEAR-TERM PORTFOLIO STANCE

More than any time in postwar history, U.S. politics dictate economics. Credit was so compromised when the pandemic hit, a combined monetary and fiscal response was required. The under -appreciated risk of the debt limit, budget resolution and lack of direct fiscal support for households should act as anchor on long-maturity Treasury yields. A flattening bias underlies the building stresses on household finances.

QI CALLS

• Getting defensive: Dividend-safe staples, gold, budget hotel chains.

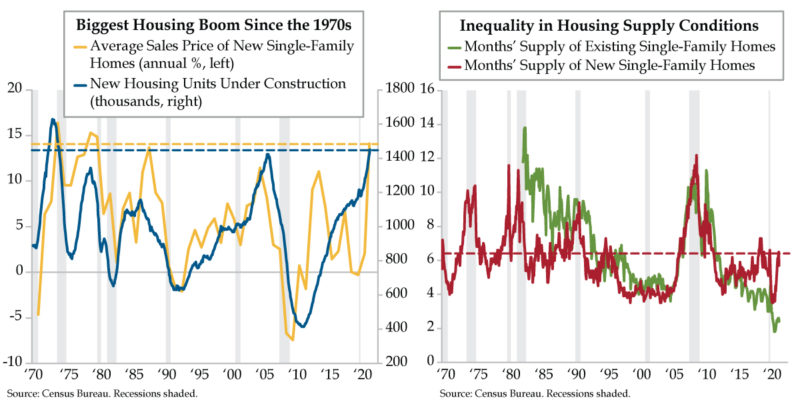

• Homebuilders have so many lots with sewage, they have no choice but to go vertical which should support lumber despite slowing housing.

• A global dearth of supply rebuild and Russian leverage in natural gas market should carry longs through winter.

• China’s deliberate deleveraging will pressure indirect beneficiaries of the property boom in the decade preceding the pandemic, especially iron ore miners that export to China.

*Seed corn: Disruptors in delivering home health care to aging Americans